Lately we’ve received a number of questions about embedded deductibles so we thought it would be helpful to talk about them with a wider audience. What are embedded deductibles, and how do they work? Before we start, let’s do a quick review on deductibles. As we’re sure many of you know, a deductible is the amount you have to pay out-of-pocket before your health insurance coverage pays for covered benefits. It’s pretty straightforward in an individual plan, but what about in a family plan?

This is where an embedded deductible comes into play. Under family coverage, an embedded deductible is the individual deductible for each covered person, embedded in the family deductible. While it might not sound like a good thing to have two deductibles, it actually works to provide better coverage for individual members because once each family member meets his or her embedded deductible, health insurance begins paying for covered services, regardless of whether the larger family deductible is met. Contrast this to a non-embedded deductible, also referred to as an aggregate deductible. Under an aggregate deductible, the total family deductible must be paid out-of-pocket before health insurance starts paying for the health care services incurred by any family member.

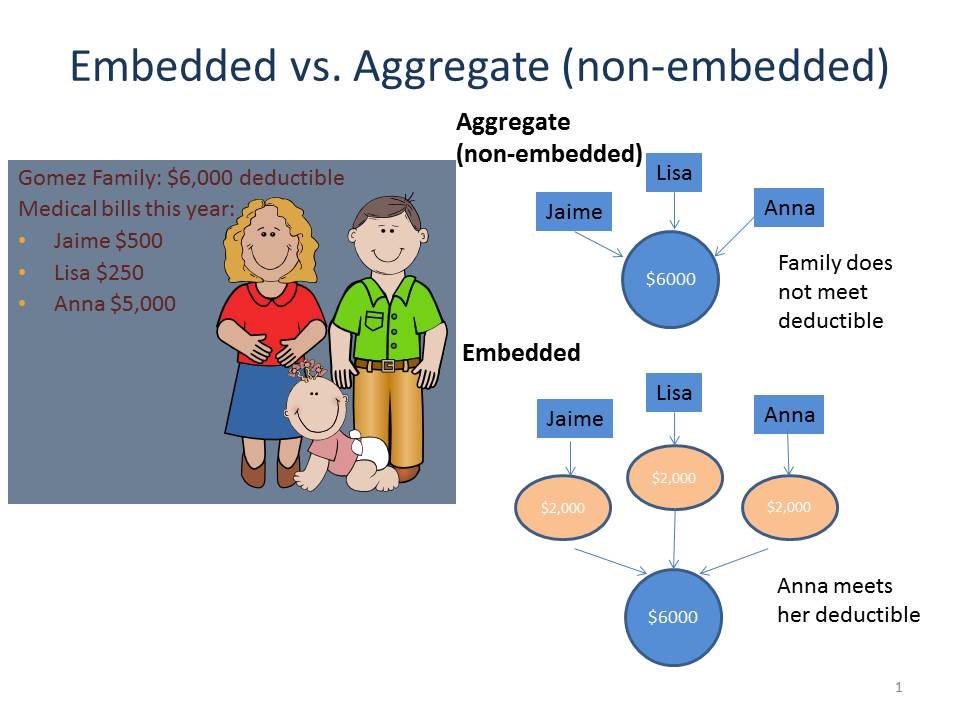

Let’s take a look at the graphic below (inspired by a similar slide from the Center on Budget and Policy Priorities) comparing how an embedded and aggregate deductible work with the Gomez family. Under an aggregate deductible, none of Jaime, Lisa or Anna’s medical bills will be covered by insurance because they haven’t met their aggregate deductible of $6,000 under their health plan. Their total expenses only reached $5,750. However, under an embedded deductible, Anna has met her $2,000 embedded deductible, so the health plan picks up the remaining $3,000 in medical bills (assuming they were for covered services), even though the family deductible was not met.

So what’s the point? Well, as open enrollment has begun and many families are signing up or thinking about switching health insurance plans, it’s good to know the difference between an embedded and aggregate deductible, particularly if you anticipate that one or more family members will have significant health care needs. While family coverage with an aggregate deductible may have a lower monthly premium, coverage won’t kick in until the total family deductible is met. In contrast, family health plans with an embedded deductible may help ensure that there is coverage for individual family members once they meet their embedded deductible, regardless of whether the family deductible is met. Unfortunately, the Summary of Benefits and Coverage won’t necessarily tell you if the deductible is embedded or not; you may have to call the plan to learn how the deductible will be applied for your coverage.

Our on-line Navigator Guide has been updated to include information about embedded deductibles. Stay tuned as we talk about Health Savings Accounts (HSAs) next week.

12 Comments

I signed up for a health plan that says the deductible is embedded. I am the only person on the health plan so what does embedded mean on an individual health plan? There is lots of information on the internet explaining embedded in a family health plan but I am having trouble finding information for an individual health plan.

Thank you, Kathy

Aggregate is only a problem when there is more than 1 person on the plan. So because it’s just you it’s a non issue. But for anyone purchasing a plan that covers 2 or more people, then it’s smart to understand the difference between Embedded and Aggregate as there is a huge difference is how claims will be paid. ACA plans have HIGH OUT OF POCKET ANNUAL MAX, which makes this point even more important.

In my case, the aggregate is much lower than the embedded. They are steering us to certain plans. $3000 Agg vs $9000 Embed, out of pocket mac is $6000 vs $13,000

It becomes an issue if you have a baby, marry, or adopt mid-plan year.

Thank you for asking all of these questions. I think all of us have been caught off guard when we thought things were covered or went to the pharmacy. This information should be clear to all consumers

So i have a high deductible plan with 4k individual deductible and 6k family as one choice. My other choice is a $2500 individual and $4k family deductible. that plan costs about 2k more in premiums for year. Deductibles are imbedded. Every scenario i run the $6000k family deductible seems like the cheapest option. is that correct? Also, i want to clarify how this works. Say three members of a family all have $2500 in medical services in a year. If that is the individual deductible, and it is imbedded, then person number one should stop paying after $2500. Person 2 will stop paying after $1500 as there was a family max of 4k ,and person 3 nothing. Correct?

Hi Rob,

If you have three member family with each one having $2,500 in medical expenses and a health plan with a $2,500 embedded/$4000 family deductible:

Family member 1 – with $2,500 in out of pocket medical expenses, she has hit the embedded $2,500 deductible; her coverage will kick in with applicable cost-sharing

Family member 2 – with $2,500 in medical expenses at least $1,500 will be out of pocket; health plan to cover remaining amount with applicable cost sharing since family deductible of $4,000 has been met

Family member 3 – with $2,500 in medical expenses; the family deductible of $4,000 has been met and health plan to cover this family member’s expenses with applicable cost sharing

Note that for the deductible, the services generally have to be provided in-network for the amounts to apply towards the deductible.

We can’t comment on the “cheapest” because we don’t know what the other cost-sharing amounts are like the co-pay or co-insurance. Generally, you pay a co-pay for every doctor’s visit and prescription filled, and the co-insurance is usually the percentage of the in-network bill that you would pay after meeting the deductible. As you can see, it can get quite complex so you’ll want to compare not only the deductible and premium amounts, but also the other cost-sharing amounts under a plan. You may want to talk to a Navigator or consumer assister in your state who will be familiar with the health plan options and can also ask you about other factors you will want to consider like what your health needs are and whether you want a plan with a particular doctor or hospital in-network, in addition to the price factor, these are all factors to consider.

If an employer offers a HDHP, embedded, can they also offer an employer funded HRA to be part of it? An HRA isn’t governed by the same IRS rules as an HSA is it?

HRAs are employer only established benefit plans. Employers can offer HRAs in conjunction with other employer-provided health benefits like HSAs. See this IRS link that discusses the interaction between HRAs and HSAs – https://www.irs.gov/publications/p969/ar02.html#en_US_2015_publink1000204042.

Hello, can you help me with the following scenario for a family plan:

Individual deductible: $2300

Family deductible: $4600

Member 1 bill: $4000

What should be counted towards family deductible in this case? $2300 or $4000?

Is there an age criteria for dividing the embedded deductibles under family coverage

Can someone please clarify what happens with an aggregate deductible when someone has a life change mid-year such as marriage or divorce?

Case 1: Mid-Year Marriage

During the benefit year, a single member on an account meets their $1500 deductible. The plan then starts to pay that person’s claims. The member then gets married, and adds the spouse to their account.

The plan will now require the $3000 Family deductible to be met. The member (and their spouse) together would be required to satisfy an additional $1500 in deductibles (so that the $3000 Family deductible is met). The plan would then start to pay again.

Is this correct?

Case 2: Mid-Year Divorce

A member has an account along with their spouse. They will be required to meet the $3000 family deductible. Assume the spouse meets $2500 of that amount, and the member meets the other $500 – The plan then starts to pay on medical claims. Then they are divorced during that benefit year.

What should happen in this case?

(A) The plan continues to pay the member’s claims, because the family deductible was met.

(B) The member is now required to meet the remaining $1000 of deductible in order to satisfy their $1500 individual deductible.

Which is correct – A, B, or something else?

7 Trackbacks and Pingbacks