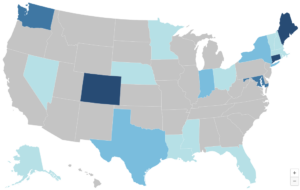

Substantial Marketplace Coverage Gains for Communities of Color Threatened Again

The Affordable Care Act (ACA) marketplaces have become vital lifelines for millions, especially for communities of color, significantly reducing the uninsured rate and expanding access to affordable coverage. However, the future of these marketplaces hangs in the balance, with political priorities influencing their stability and funding, particularly regarding federal subsidies. As the 2024 election cycle approaches, the choices voters make could reinforce the progress achieved or risk undoing critical health care coverage advancements.