By: Jack Hoadley, Kevin Lucia, and Maanasa Kona

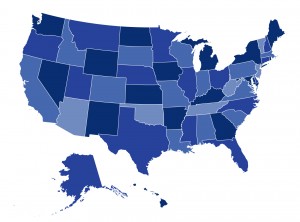

This year has seen increased reporting on the issue of balance billing and a flurry of state-level action to solve it. Balance billing occurs when patients who are covered by insurance seek medically necessary care from out-of-network providers either due to an emergency or because an in-network facility used the services of an out-of-network provider. The insurer will often limit its payment to an amount it determines is fair and the out-of-network provider may bill the patient for the difference. The 2019 legislative session saw five states move towards protecting their consumers from this practice, bringing the total number of states with protections in place up to 27.

In their latest post for the Commonwealth Fund’s To the Point blog, CHIR’s Jack Hoadley, Kevin Lucia and Maanasa Kona take a closer look at the protections against balance billing enacted by the latest set of states to tackle the issue and find that state approaches to solving this problem are evolving. However, the researchers also find that despite this progress, there is still a need for federal action because (1) 23 states and the District of Columbia still lack protections, and (2) only federal law can apply balance billing protections to employer-sponsored insurance, which covers the majority of Americans. You can also find state-by-state information on balance billing protections in our new interactive map.

1 Comment

Here is my latest article on what national balance billing legislation should look

HEALTH REFORM JOB ONE:

STOP THE GOUGING!

WE NEED LEGAL ASSAULTS ON THE GREEDIEST PROVIDERS

By Bob Hertz

Editor, New Laws for America

Bob.Hertz@frontiernet.net

Assault Phase One: Outlaw surprise billing

This rule must become universal:

If a hospital is ‘in-network’, then any doctor who practices in that hospital is ‘in-network.’

To enforce this, we should adopt Connecticut’s law on surprise billing and balance billing for the entire nation.

Connecticut’s law No.15-146, which took effect July 1, 2016. states the following:

“If a patient receives a “surprise bill” from a health insurer for Out-of-Network services provided at an In-Network facility – the patient will only be responsible to pay the co-insurance, co-payment, deductible, or other out of pocket expense that would apply – if the services had been provided by an In-Network provider. The physician is reimbursed at the in-network rate, unless the patient and provider agree upon something else in advance.”

In addition:

• Patients who see Out-of-Network providers for emergency services can only be required to pay the equivalent of In-Network costs. This includes Out-of-Network hospitals, transportation services, and providers who are Out-of-Network practicing within In-Network facilities.

-1-

In addition:

• It is illegal in Connecticut for any provider to request extra payment from a patient who is covered by insurance — as the entire purpose of insurance is to negotiate prices for you.

• It is also an unfair trade practice for a health care provider to report a patient’s unpaid surprise medical bill to a credit reporting agency.

Other Connecticut rules include:

• A patient who still receives a surprise bill from an out of network provider in excess of what the patient would owe under the plan’s in-network rate can seek actual damages, punitive damages, and injunctive relief based on the Connecticut Unfair Trade practices Act.

• Connecticut also prohibits health plans from imposing a facility fee for outpatient visits at an off-campus site of a hospital. In fact, billing statements to patients must include a notice that the costs might have been less if they had had the procedure performed at a facility not owned or operated by the hospital or hospital system, and that the patient has the right to request a reduction in the fee.

• For uninsured patients, Connecticut providers may not charge more than the applicable Medicare rate.

Only six states have laws that are even close to this level of patient protection. Let’s establish the Connecticut standard nationwide.

Assault Phase Two: Regulate the fees of emergency rooms and ambulances.

Any hospital ‘contract’ that is signed upon an emergency admission is legally flawed. Such contracts are in fact procedurally unconscionable — because the only way for the weaker party to acquire the services is to agree to the terms dictated by the stronger party. Signed admission forms, which include a promise to pay, absolutely do not constitute mutual assent.

Here is the solution:

• If an ER patient is insured, then the hospital must accept ‘mandatory assignment ‘ of benefits –

i.e. if the insurer pays $500, then that closes the account. (as long as the insurer pays at least as much as Medicare.) No balance billing would be allowed for emergencies. As described in Connecticut law, a patient who received a balance bill (other than their deductible) could sue for damages.

-2-

• ER doctors would be barred from billing separately for emergency, ancillary, and hospitalist services. The hospital would be responsible for paying them, and for collecting reimbursement from insurance networks.

Of course hospitals will complain. Many of them have been ambushing emergency patients with huge out-of-network bills, basically to put pressure on insurers to raise their payment rates. Patients are caught in the middle of the power struggle, and this must cease.

Hospitals are supposed to fight emergencies, not cause them. They must be forced to stop abusing their monopoly position toward emergency patients.

Important note:

Hospitals do deserve lump-sum federal subsidies for uncompensated emergency care. The EMTALA act (which mandates that all patients must be stabilized, whether or not they can pay) was totally unfunded. That was a mistake that can be corrected now.

For the insured population:

Emergency care must be exempt from the deductible in all health insurance plans. (ER Co-pays up to $250 are acceptable.)

The ridiculous HSA plans (where absolutely nothing is covered until a high deductible is met) must be legally amended.

In addition:

Ambulances should be fully funded by the federal government, including air ambulances. The cost would be from $14 to $18 billion a year, which is about ten days worth of Medicare spending.

It is far better for us all to pay a few dollars a year in extra taxes, versus a tiny number of us to be stuck with a huge ambulance bill. Medical transport should be a public service, instead of another industry on the take.

Note: We could allow a $100 user fee, in order to discourage the use of ambulances for non-urgent transport to drugstores or to doctors’ appointments. There could be a $500 user fee for air ambulances.

-3-

Assault Phase Three – Challenge Big Pharma

Step One – Less Regulation of Generic Drugs

If an off-patent drug has been approved by other first-world nations, this would constitute automatic approval by the FDA.

The price gouging around Epipen would have ended quickly, if new versions of genetic drugs did not require an FDA approval process. We should let reputable drug companies produce whatever generic drugs they want.

If an office products company like Staples tried to charge $50 for a box of paper clips, a competitor would have a price of $1 on the street in a week.

But not in the drug industry! If the FDA was involved, Staples paper clips would in effect be protected for years even though no patent is involved. Competitors would be bogged down for years in litigation, or in waiting for the FDA to prove that no one could cut their finger on a non-Staples clip.

It is wasteful for the FDA to take over two years to review competitive generic drugs, when the original version has been on the market for years and poses zero danger to anyone. Companies must be prevented from ‘stealing’ popular and effective drugs that have been in the public domain for years, and then claiming them as private property until their competitors can slog through FDA approval. By the time the FDA gives anyone else permission to compete, the price gougers will have made their fortune and can move on to their next scheme.

-4-

like……………..