By Jack Hoadley and Kevin Lucia

In December 2020, Congress enacted the No Surprises Act, which is designed to protect all Americans from surprise medical bills from out-of-network providers. But many states did not wait for federal action. Seven states enacted new surprise billing laws in 2020; five of these provide comprehensive protections. These laws raised the total number of states with protections to 33, including 18 with comprehensive protections.

The No Surprises Act of 2020

The No Surprises Act will ensure, starting in 2022, that all Americans are protected from financial liability (beyond in-network cost sharing) when they are provided emergency services by an out-of-network facility or provider, including an air ambulance, or when they are treated by out-of-network providers at in-network facilities. Today, where state laws do not apply, patients are responsible for bills over and above what their insurer elects to pay. An important component of the law is establishing the payments made by the patient’s insurer to the out-of-network provider. The law calls first for negotiations between the insurer and the provider. If negotiations fail, the insurer and provider may elect to use the federal independent dispute resolution (arbitration) process. The arbitrator reviews the bid amounts submitted by the parties and selects one of those amounts. The law specifies a set of factors to be used by the arbitrators in making decisions.

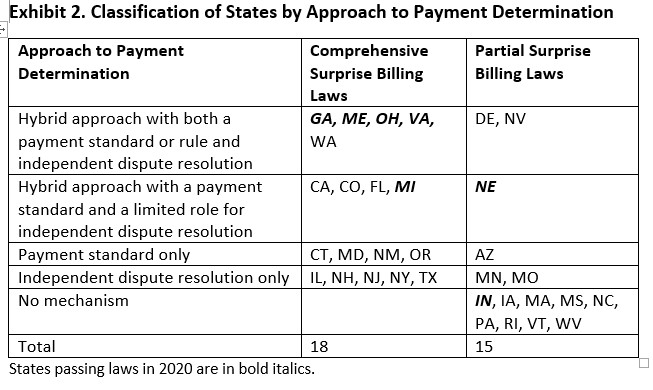

A key component in both the federal law and the comprehensive state laws is a process to determine how much insurers should pay providers for services that are delivered out of network. Insurers and employers generally prefer a payment standard, such as the median in-network rate for the same service or a multiple of the Medicare rate. Most provider groups prefer to rely on independent dispute resolution (arbitration), enabling them to make a case for higher rates. The federal law relies solely on private negotiations and an arbitration process to establish how much the insurer will pay. By contrast, many state laws use a hybrid approach that requires an initial payment based on a payment standard or rule, while also allowing either the plan or provider to request arbitration if the payment is not satisfactory.

Specific provisions in the state laws are shown in this interactive map. The federal law leaves these state methods in place for the plans and services regulated under state law.

This post updates an earlier post on state activities in 2020 and highlights the increasingly popular hybrid approach states have adopted to determine payments. It also compares this approach to that established in the No Surprises Act.

“Hybrid” Approach to Out-of-network Payment Disputes Helped Several States Achieve Compromise

States that were early adopters of comprehensive balance billing protections tended to rely on a single method for resolving payment disputes. For example, Maryland (2010) and Connecticut (2016) chose to apply a payment standard, whereas New York (2014) and New Jersey (2018) relied solely on arbitration.

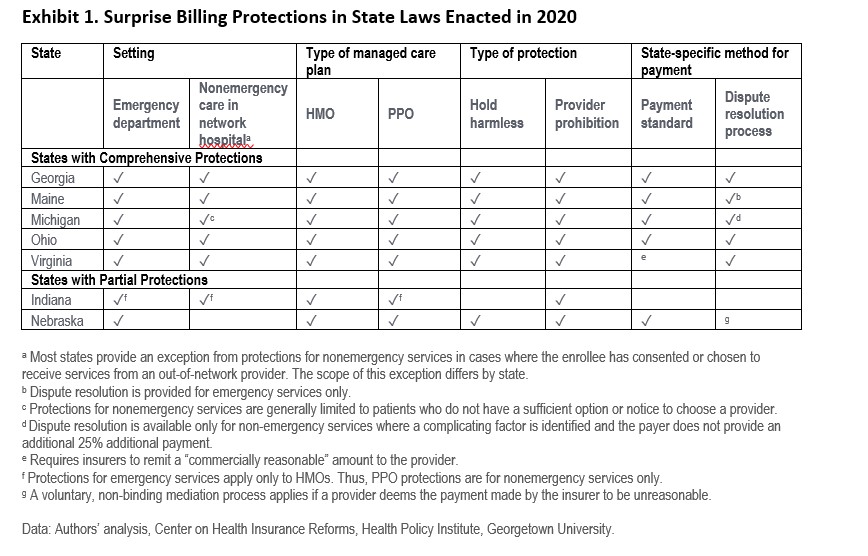

Other states, however, struggled to enact much-needed protections for patients because of the polarized positions of insurer and provider stakeholders, with insurers pushing for a payment standard and providers for arbitration. In 2019, Colorado and Washington successfully broke the logjam, becoming the first states to pioneer the hybrid approach. Other states took notice, and in 2020, seven new states enacted balance billing protection laws. Six of the seven (GA, ME, MI, NE, OH, VA) took the hybrid approach, establishing a standard for the insurer’s payment, followed by a dispute resolution process if the provider is dissatisfied with the amount received. See Exhibit 1.

Some state laws came after years of unsuccessful efforts. The Georgia legislature, for example, failed to reach a compromise over several sessions, as insurer and provider stakeholders pushed competing bills. In 2020, the logjam broke after key leaders met repeatedly to find agreement. The story was similar in Virginia, where a previous legislature created a task force to identify a particular combination of elements on which Virginia stakeholders could agree.

In Michigan, employers and insurers were most enthusiastic about their new law, while the medical society “made peace” with it. One stakeholder in Ohio praised their new law’s hybrid approach as unique in having support from “health plans, health providers, advocacy groups and business organizations.”

Hybrid Approach Wins the Day, but Methods Vary

Of the 18 states with comprehensive balance billing laws, nine now have some version of a hybrid approach to resolving out-of-network payment disputes. See Exhibit 2.

Georgia, Maine, and Ohio illustrate the hybrid approach by combining a payment standard with arbitration. For example, Georgia requires a prompt payment by plans using their median in-network rate with an option for arbitration. Ohio uses the greatest of the median in-network rate; the usual, customary, and reasonable amount; and the Medicare rate. Parties can seek arbitration for individual or bundled claims over $750. Maine also uses the in-network rate for initial payments.

Virginia uses a payment rule rather than a payment standard, specifically that the plan must pay a “commercially reasonable rate” based on payments for same or similar services in a similar geographic area. Either party may request negotiation and arbitration – allowing providers to appeal if initial payments are unsatisfactory.

In Michigan’s hybrid approach, arbitration is limited to cases with documented medical complexity. This is similar to Colorado, where payment based on the state’s standard can be challenged if insufficient given the complexity and circumstances of services.

The Nebraska law, applying only to emergency services, has a payment standard based on either a prior contracted rate or 175 percent of Medicare. It allows appeal to a voluntary, non-binding mediation system.

Indiana, alone among the new state laws, has no mechanism to establish payment amounts. Its approach leaves payment open to negotiations between the parties.

How will the No Surprises Act Affect States’ Hybrid Approach to Resolving Payment Disputes?

When considering how the federal No Surprises Act will affect the existing state laws, an important consideration is that the federal law defers to state laws that establish a method for determining payment, regardless of the method used in the state. In states that lack a method for determining payment or have no surprise billing law, the federal method will be used. And the federal method will apply for self-funded coverage offered by employers, which are not subject to state regulation.

Looking Forward

Once the federal No Surprises Act takes effect in 2022, state mechanisms for determining out-of-network payment amounts will still operate for state-regulated markets. Six of the seven states passing laws in 2020 will use their hybrid approaches to set payment amounts for state regulated plans. It is expected that because Indiana has no process to determine payment, stakeholders there will use the federal system.

In states with payment dispute mechanisms, providers and insurers will operate under two systems depending on the type of insurance held by the consumer. This may create some confusion and inconsistencies, but it will offer an opportunity to assess the differential effects of the federal system – with no payment standard but strict limits on arbitration – compared to state systems with a payment standard or fewer arbitration guardrails. While consumers should be protected from surprise bills either way, systems that create different rates could influence consumer premiums. Lessons from this comparison should guide state and federal policymakers in future decisions.

Editor’s note: The authors thank the Commonwealth Fund for their support of this research.

1 Trackback or Pingback