By Emily Curran and Justin Giovannelli

Since implementation of the Affordable Care Act (ACA), insurer participation in the ACA marketplaces has fluctuated annually, as insurers refined their health plans and responded to federal regulatory changes. However, in the last two years, states have seen less variation in the number of statewide insurer entrants and exits, although plan choice in rural areas remains a challenge. As states prepare to enter their annual rate review processes for 2020, we interviewed officials in seven of the state-based marketplaces to understand their strategies for maintaining insurer participation in 2019 and how marketplace competition might look like in the future.

A More Stable Environment

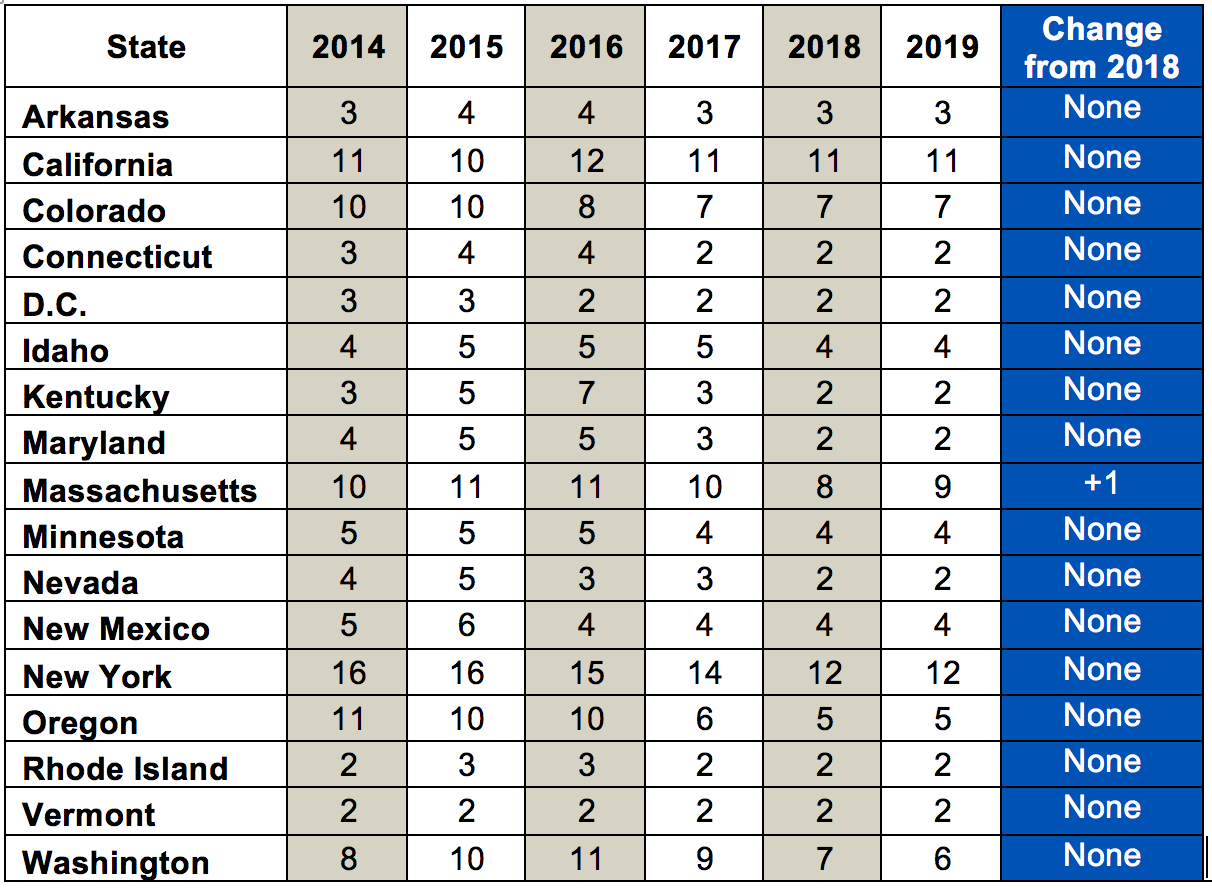

Insurer participation in the 17 state-based marketplaces continued to stabilize in 2019, with only one state – Massachusetts – experiencing a net change in the number of insurers selling on-marketplace policies. Only a handful of others experienced changes at the county-level; in Kentucky, for example, Anthem re-entered thirty-four counties that it had withdrawn from in 2017. Among those interviewed, most felt that 2019 was a “quieter” year for insurers’ service area changes, compared to prior cycles. Some attributed this to less instability in federal policymaking after Congress failed to repeal the ACA in 2017, while others commented that their insurers have simply become more adept at responding to federal uncertainty.

Insurer Participation 2014 – 2019, Total Number of Insurers Selling On-Marketplace*

| *Authors’ analysis of annual rate filings and state reports; counts take into consideration state-reported feedback regarding the number of licensees and subsidiaries under a parent company. |

While all states remain open to new insurer entrants and encourage county-level expansions, a few states suggested they have likely reached “maximum” participation at the state level and are no longer actively recruiting new insurers. Those interviewed feel confident that their current insurers will continue participation moving forward, barring any major federal policy changes or adverse litigation outcomes. As one state described, “We have enough carriers . . . we’re just planning on them and they’re hopefully planning on us.”

Still, there remains significant variability across and within states when it comes to consumer choice. Several states remarked that providing sufficient choice in rural areas remains an ongoing challenge. For example, two of the states interviewed each have fourteen counties with only one participating insurer, and costs are highest in those counties.

Barriers to Rural Competition

States noted several barriers to competition in rural areas, including the increasing costs of healthcare and insurers’ need for return on investment. Expanding into a new county can be costly for insurers, particularly if there is a scarcity of providers who can use their clout to command high prices. The companies must weigh whether the investment is worth the possibility of gaining only a few hundred additional enrollees. For example, in one state, an insurer withdrew from a county because it perceived the costs charged by dialysis centers to be too high. The state noted that contracting with such centers has been “challenging” and pushed at least this insurer to a “tipping point” in 2019. Another state echoed these sentiments, observing that in one of its rural counties, “providers really don’t want to come to the table[.]” Similar contract disputes have triggered standoffs across the country, as providers and insurers attempt to find a middle ground on pricing.

Additionally, the low population density of some rural areas means that just one high-cost enrollee can throw off an insurer’s pricing strategy for that rating area. Not surprisingly, states reported that their insurers are unlikely to expand their county-level participation unless doing so complements their broader business strategies.

States Enact Policies to Promote Competition

In part to compensate for some of these longstanding barriers, several states have in place market rules to promote competition.

- In Massachusetts, insurers are required to sell marketplace policies if they enroll over 5,000 individuals in the merged individual and small group markets. This requirement pushed UnitedHealth Group to join the marketplace for 2019, after its small group enrollment surpassed 5,000.

- In Minnesota, the legislature passed a law in 2017 allowing for-profit health maintenance organizations to do business in the state, lifting a restriction that had been in place for decades. The state recently issued the first of these licenses, though it remains to be seen which markets the insurer will enter for 2020.

- In New York, the Governor called for emergency regulations to prevent any insurer who withdraws from marketplace from participating in the state’s public health programs. Though the prohibition wasn’t triggered in 2019, state officials suggested the incentive helped maintain competition on the state’s marketplace.

- In Washington, beginning in 2020, insurers who participate in the school employee or public employee benefit programs must also offer coverage on the marketplace in the same counties. The state expects that this requirement will bring several new insurers into the marketplace.

These efforts showcase the various levers states have to promote competition. However, such proposals are not always popular with insurers. In fact, though all the states reported that they maintain strong partnerships with their insurers, these and other recent legislative efforts are exposing at least some diverging priorities.

Looking Forward

Statewide insurer participation in 2019 reflects ongoing stability and increasing profitability in the state-based marketplaces. However, county-level participation highlights the challenges of securing choice in rural counties. Attracting robust insurer participation in rural areas has always been challenging, given geographic and network barriers. Some states acted early on to address this by implementing tying requirements and using their authority to provide flexibility for insurers, when possible. While these approaches are not always popular with industry, they offer one avenue for increasing choice in hard-to-fill areas.

Support for this research was provided by The Commonwealth Fund.