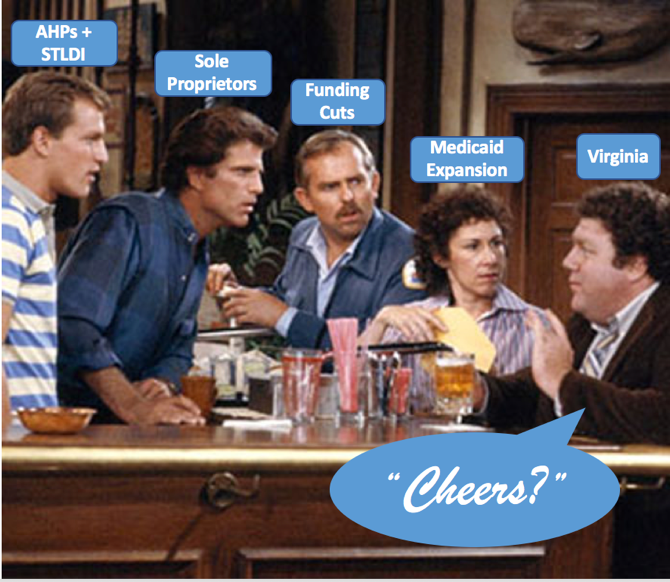

What do you get when a short-term health plan, an association health plan, sole proprietors, Medicaid expansion, and Navigator funding cuts walk into a bar…? You guessed it: Virginia!

Across the country, states are yet again dealing with policy changes just before the fall open enrollment season. Virginia, however, is a special case. Not only is the state about to extend Medicaid eligibility to approximately 400,000 new residents, consumers at the same time will face the expansion of short-term limited duration health insurance (STLDI) and association health plans (AHPs). This year the state also changed its definition of small employers in order to give sole proprietors greater access to the group market. Unfortunately, amidst all of these changes, the federal government cut Virginia’s navigator budget for outreach and enrollment by more than half from last year. So, at the same time Virginia residents are facing new and confusing coverage choices, there will be less help available to guide people to the coverage option that’s right for them. Let’s break down the new policies and how they might affect consumers across Virginia.

Medicaid Expansion

After five years of debate, the Virginia legislature expanded Medicaid in May 2018, giving coverage access to a projected 400,000 low-income Virginians, many of whom were stuck in the Medicaid Gap. The expanded program begins enrollment staring November 1, with plans beginning on January 1.

Medicaid expansion has proved itself beneficial in the other 34 states and DC that have gone down the same path. It has significantly reduced the uninsured population, leading to increased access and affordability of health care services, and improved health outcomes.

What’s the catch? Virginia has proposed to implement work requirements and nominal premiums for certain beneficiaries as a condition of some Republican support of the expanded program. However, evidence shows that taking people’s coverage away actually does not help them find employment – quite the opposite, in fact. Imposing additional bureaucratic hurdles are also administratively burdensome for both the state and the beneficiary.

Expansion of Short-Term Plans

In August 2018, the Trump Administration finalized their rule expanding the availability of STLDI plans from 90 days to 364 days, and added the ability to renew the plan for up to three years. As we’ve explained, such plans do not have to cover the same benefits as ACA-compliant coverage, and can deny coverage to people with pre-existing conditions, cap benefits, and exclude critical services like prescription drugs, maternity care, and mental health treatment.

Unlike a number of other states, Virginia does not limit the duration of short term plans or otherwise hold them to the same standards as ACA plans. On one hand, consumers who have been priced out of the ACA market will have more access to some insurance, even if it isn’t comprehensive. On the other hand, these same consumers could find themselves in financial trouble if they have an unexpected medical event and need services that the short-term plan won’t cover. There is also a risk to Virginia’s marketplace if healthy people gravitate to short term plans, leading to higher premiums in a state market that has only recently begun inching toward stabilization.

Expansion of Association Health Plans

Around the same time the Trump Administration expanded STDLI plans, they also expanded the availability of AHPs. The new rule gives small businesses and self-employed individuals the ability to join or form associations with other businesses in the same trade, industry, line of business, or businesses in the same geographic region. These AHPs do not have to adhere to ACA rules on essential health benefits, limits on age rating, the single risk pool, and the risk adjustment program.

Insurance experts worry about AHPs’ long history of fraud and insolvency that left consumers and providers with unpaid medical bills, but also the adverse selection these looser restrictions could cause. Loosening the age bands, not requiring a single risk pool, and exempting plans from ACA consumer protections could siphon the healthiest and youngest individuals and groups away from the ACA markets, leaving older and sicker people with ever rising premiums.

Although new AHPs were allowed to form under the relaxed rules beginning September 1st, it is not yet known how many will take hold in Virginia. Other states are already seeing this market grow, and twelve state attorneys general are suing the administration over the rule, citing the history of fraud and evidence that they undermined states’ individual and small group markets.

Changes to the Definition of Small Employer

In response to extremely high individual market premiums in some parts of Virginia last year, the state legislature passed a law that broadens the definition of small employer in the state. Self-employed individuals (sole-proprietors) are now eligible to purchase insurance in the group market. Although this covers a relatively small population of Virginians, it could significantly expand their coverage choices.

Funding Cuts to Outreach and Enrollment

In the midst of these dramatic market changes, the support for ACA marketplace outreach and personal assistance is shrinking. In Virginia, after devastating funding cuts in 2017, Navigators worked double time to have a successful enrollment season. This year, Virginia Navigators just have $525,000 across the entire state for outreach, education, and enrollment.

These resource constraints present a huge challenge for Navigators and certified application counselors (CACs) to not only keep up their successful enrollment numbers on the individual market, but also assist in the enrollment of the 400,000 newly Medicaid-eligible individuals and the hundreds of thousands additional uninsured individuals across the state. With appointment times averaging 90-minutes per consumer, Navigators and volunteer CACs have their work cut out for them, especially when a lot of the remaining uninsured are among the most difficult to reach.