Emily Curran, Kevin Lucia, Sabrina Corlette, Dania Palanker

Last week, the Trump administration issued a final rule reversing federal limits on short-term health coverage, allowing such plans to become a long-term alternative to individual market coverage. Starting in October, insurers will be allowed to sell short-term plans for just under 12 months, up from the current federal limit of three months. And in a sharp break from prior regulations, insurers can renew short-term plans for up to 36 months. The rule does strengthen a consumer notice required in application materials, but the notice does not need to inform consumers of all limitations and “fine print.” Importantly, the rule does not preempt state regulation that includes shorter limits on coverage. To learn more about the final rule, you can read more here.

Short-term plans are not required to comply with the Affordable Care Act’s (ACA) consumer protections, meaning insurers that sell these policies can deny coverage to individuals with preexisting conditions and are not required to cover essential health benefits. These plans are typically marketed to healthy consumers, for whom coverage with limited benefits and a low premium may appear attractive.

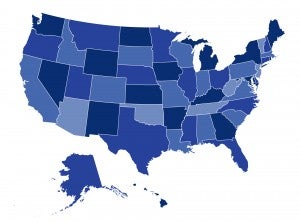

In our latest To the Point post for the Commonwealth Fund, we surveyed the Departments of Insurance (DOIs) in the 17 state-based ACA marketplace states to understand how the market for short-term coverage is working on the eve of this policy shift. We found that most states have little information about the status of their current short-term plan markets. Additionally, inconsistencies in how states have collected and reviewed the premium rates and contracts for short-term plans will make it difficult to assess how the market is responding to the new federal rules. To learn more, you can read the full post here.