Short-Term Health Plans Sold Through Out-of-State Associations Threaten Consumer Protections

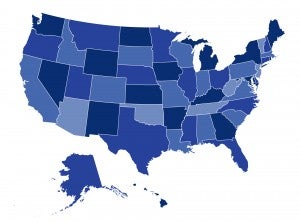

The expansion of short-term policies has raised concerns that they may be deceptively marketed, with some sellers leading consumers to believe they are buying a comprehensive policy when they are not. While twenty-four states have sought to regulate short-term plans, their efforts may be undermined by a loophole that allows the policies to be sold through out-of-state associations – a practice we found to be quite common.