Tag: short term limited duration

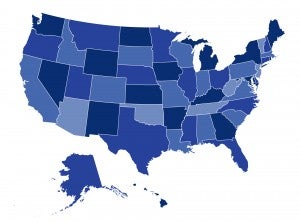

Biden Administration Sets Limits on Use of Short-Term Health Insurance Plans, But States Can Do More to Protect Consumers

A recently proposed federal rule aims to mitigate the harm of short-term insurance plans, products exempt from the Affordable Care Act’s consumer protections. In a post for the Commonwealth Fund, Justin Giovannelli, Kevin Lucia, and Christina L. Goe explain the proposed federal rule and describe what else states can do to further protect their residents.

The Perfect Storm: Misleading Marketing of Limited Benefit Products Continues as Millions Losing Medicaid Search for New Coverage

A massive coverage transition is underway for millions of people who have relied on Medicaid throughout the COVID-19 pandemic. After a three-year pause, states have begun disenrolling residents from Medicaid, leaving millions of people in need of new coverage. A secret shopper study conducted in June 2023 suggests that people losing Medicaid are facing aggressive marketing of limited benefit products.

The Feds Crack Down on Sham Insurance: New Court Order to Protect Consumers from Deceptive Marketing

Last month, the Federal Trade Commission (FTC) took action against Benefytt Technologies, finding the company relied on deceptive websites, high-pressure sales tactics, and misleading information to push consumers into enrolling in junk plans, and then made it difficult for consumers to cancel their coverage. CHIR’s prior research on the marketing of junk plans shows that these tactics are neither new nor unique.

The Congressional Budget Office Definition of “Health Insurance” Leaves Room for Wide Coverage Gaps, Discrimination

The nonpartisan Congressional Budget Office (CBO) frequently estimates how policy proposals will affect rates of health insurance coverage. To make these assessments, the agency relies on a definition including coverage that can discriminate against people with pre-existing conditions and fail to cover key health services like prescription drugs, practices that are outlawed in the individual health insurance market under the ACA. CHIR’s Rachel Schwab takes a look at the CBO’s current definition of health insurance, and the impact it has on health insurance reform efforts.

Trump Administration Promotes Coverage That Fails to Adequately Cover Women’s Key Health Care Needs

The ACA expanded women’s access to comprehensive coverage. The Trump administration is seeking to overturn the law while promoting coverage options that are exempt from the ACA’s consumer protections, including short-term plans and health care sharing ministries. In a new post for The Commonwealth Fund, CHIR experts examine the differences between ACA plans and the alternatives promoted by the Trump administration, finding that these products frequently exclude or severely limit coverage of services that are critical to women’s health.

U.S. House Investigation Offers New Evidence on the Dangers of Short-Term Plans

On June 25, the House Committee on Energy and Commerce released the results of a year-long investigation into the practices of the Short-Term Limited Duration Insurance industry. The Committee looked into 14 companies that sell or assist consumers in enrolling in short-term plans, and its findings confirm what we have known for some time – short-term plans are a bad deal for consumers. CHIR’s Emily Curran discusses five highlights from the Committee’s report, including new evidence on the status of the STLDI market.

Idaho Misses Opportunities to Help Consumers Get Affordable, Comprehensive Health Coverage During COVID-19 Pandemic

Since the COVID-19 pandemic began, states have taken charge of responding to the public health emergency. As a state that runs its own health insurance marketplace, Idaho has tools at its disposal to help consumers enroll in comprehensive coverage. But like the federal marketplace, Idaho decided not to wield all of them, leaving large marketplace enrollment barriers and instead promoting alternative and less comprehensive coverage.

In the Age of COVID-19, Short-Term Plans Fall Short for Consumers

During February’s State of the Union address, President Trump touted his administration’s efforts to expand access to short-term health plans that do not comply with any of the ACA’s consumer protections. Short-term plans are often cheaper than ACA-compliant plans because they can deny coverage to people and exclude entire categories of services. In a recent post supported by The Commonwealth Fund, we reviewed 12 short-term plans to determine what coverage consumers would have if they needed treatment for COVID-19. We found that consumers in short-term plans are likely to have less financial protections than those enrolled in ACA plans.