Since the COVID-19 pandemic began, states have taken charge of responding to the public health emergency. In addition to efforts that began when the novel coronavirus reached the U.S., previously established policies have shaped state responses. Some state policies have opened doors to helping consumers, such as running a state-based marketplace or protections against surprise medical bills. Other policies have hindered state responses, including the decision not to expand Medicaid under the Affordable Care Act (ACA).

As a state that runs its own health insurance marketplace, Idaho has tools at its disposal to help consumers enroll in comprehensive coverage. But like the federal marketplace, Idaho decided not to wield all of them.

The Good News: Idaho Has Tried to Lower Enrollment Barriers

The COVID-19 pandemic and related economic shutdown have caused a surge in unemployment, income reductions, and insurance losses. The pandemic struck at a time when marketplace enrollment is usually restricted to a small set of circumstances that trigger “special enrollment periods” (SEP), including the loss of employer-based coverage. In response to the public health emergency, the Centers for Medicare and Medicaid Services (CMS) indicated that it will reduce some of the usual documentation requirements for consumers seeking a SEP on HealthCare.gov.

Idaho has also taken steps to reduce the burden on consumers who need to enroll in coverage through the state’s ACA marketplace by cutting back on cumbersome paperwork for those who lose their employer coverage. Rather than go through the usual verification process, consumers can submit a written statement describing their recent loss of job-based health insurance, although they may be asked to provide verification documentation after enrollment in order to keep their coverage.

The Bad News: Idaho Officials Left a Large Barrier in Place

Despite efforts to ease the enrollment process for consumers, Idaho has not taken advantage of an opportunity to enroll uninsured residents. As a state that runs its own health insurance marketplace, Idaho can create a new enrollment opportunity for uninsured consumers. Twelve of the thirteen state-based marketplaces decided to open a new SEP in light of the COVID-19 pandemic. These SEPs allow the uninsured who don’t experience a qualifying event to enroll in coverage during a time when access to medical services and financial protection are of the utmost importance. As the one holdout, Idaho joined the Trump administration in refusing to re-open the marketplace to the uninsured during a global pandemic and economic shutdown that has left millions without jobs or otherwise reduced incomes.

State-based marketplaces that opened a COVID-19 SEP have reported robust enrollment volumes since they announced the signup opportunity, and six are still actively enrolling the uninsured. In Idaho and the 38 states that rely on HealthCare.gov, the uninsured who do not experience a qualifying life event (such as losing job-based coverage) or who miss the 60-day special enrollment window cannot access marketplace coverage.

Instead of a Special Enrollment Period, Idaho is Promoting Short-term Health Plans

Rather than establishing a SEP, Idaho’s insurance department is encouraging uninsured consumers to enroll in what it calls “enhanced” short-term plans. But while a SEP would allow the uninsured to sign up for insurance that covers pre-existing conditions and comprehensive benefits, with most applicants qualifying for premium tax credits, Idaho’s enhanced short-term plans could leave enrollees who get sick holding the financial bag.

During the COVID-19 Pandemic, Idaho’s Enhanced Short-term Plans Have Limitations

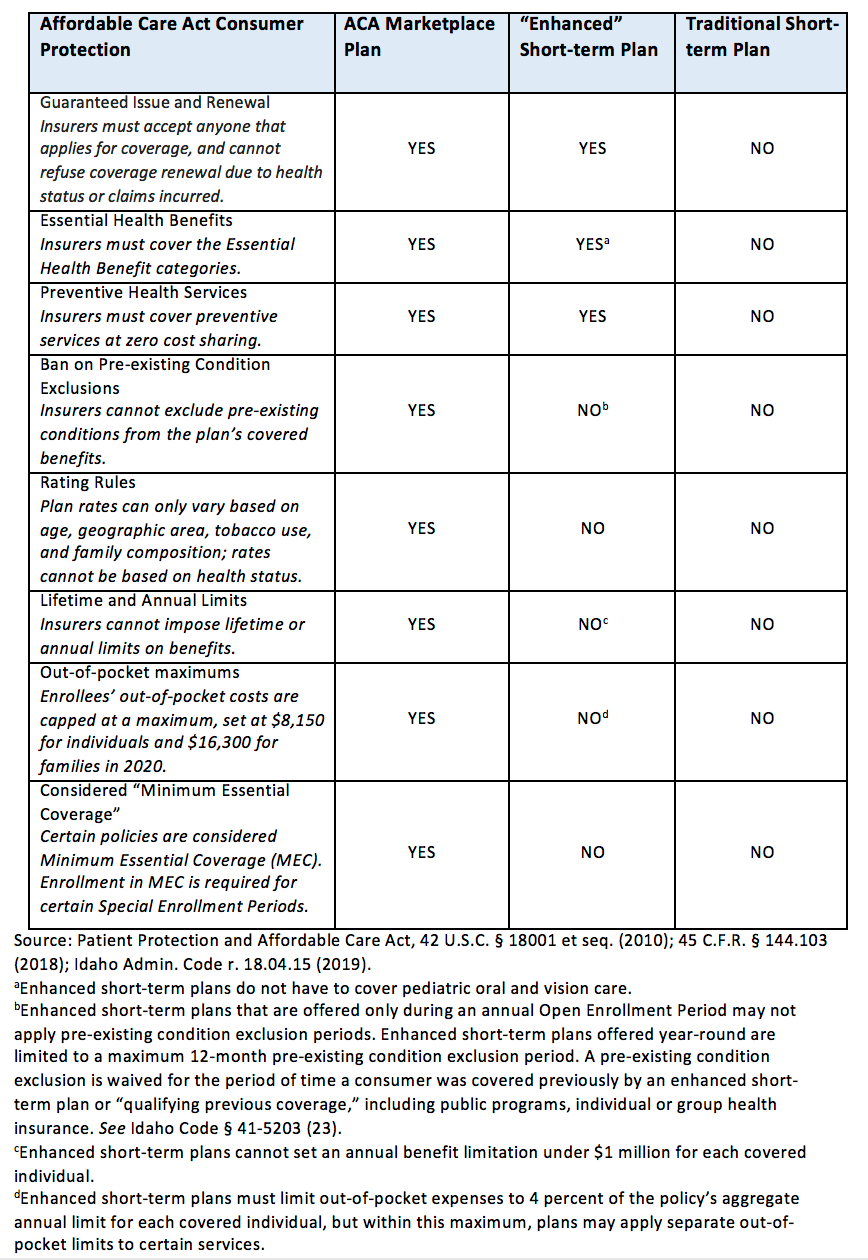

Last year, Idaho’s insurers began offering a new health insurance product to Idaho consumers, called enhanced short-term plans. The state has plugged these plans as an affordable alternative to ACA-compliant coverage, and intends to allow companies to sell them using the state-based marketplace website. But while Idaho’s insurance department describes enhanced short-term plans as “fully-comprehensive [sic],” they have numerous limitations (See Table).

Table. Application of Affordable Care Act Consumer Protections in Private Coverage

Unlike marketplace plans, Idaho’s enhanced short-term plans are medically underwritten; insurers can charge higher premiums to sick people and impose waiting periods for pre-existing conditions for up to a year if the plans are offered year-round. These products can include caps on benefits (prohibited for marketplace plans), and allow consumers to rack up much higher out-of-pocket costs – one product sold in Idaho has a $20,000 deductible and a $50,000 out-of-pocket maximum for a family, and some products have a separate deductible for maternity coverage.

What’s more, while a SEP to enroll in marketplace coverage would allow consumers to access financial assistance (for incomes up to 400 percent of the Federal Poverty Level), federal subsidies for health coverage are not available for enhanced short-term plans. In fact, enhanced short-term plan enrollees are considered uninsured by the federal government.

In the midst of the COVID-19 pandemic, people with non-ACA-compliant plans may find themselves on the hook for thousands of dollars after seeking needed medical care. To be sure, Idaho’s enhanced short-term plans are more comprehensive than many of the “junk” plans out there – they have to cover most of the ACA’s essential health benefits and must be guaranteed issue and renewable at the option of the enrollee (See Table). Most of Idaho’s domestic issuers of the enhanced short-term plans have also opted to waive cost-sharing for in-network COVID-19 testing for enrollees. However, enhanced short-term plans’ higher premiums for applicants with health conditions could render them unaffordable for some, and pre-existing condition waiting periods could prevent many from using their benefits. Worse, because short-term plans don’t count as “health insurance,” by the time enrollees realize their plan is inadequate, many who signed up for these products after losing job-based coverage will have missed their 60-day window to enroll in a subsidized, comprehensive marketplace plan.

Takeaway

The ACA’s marketplaces were created to ensure that consumers without access to employer coverage have a comprehensive, affordable insurance option, regardless of income or health status. As a state-based marketplace, Idaho has chosen not to connect the remaining uninsured to comprehensive, affordable coverage that will provide peace of mind and financial protection in the midst of a pandemic. Instead, state leaders are pushing alternative plans that could leave many consumers with unexpected and high medical bills.