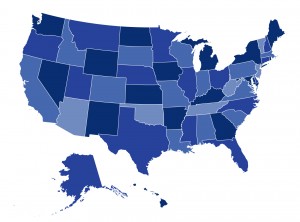

State Protections Against Medical Debt: A Look at Policies Across the U.S.

Medical debt is one of the leading causes of bankruptcy in the United States. Though federal law provides some protection against medical debt and its downstream consequences, the federal framework has significant gaps. In a new report for the Commonwealth Fund, CHIR’s Maanasa Kona and Vrudhi Raimugia examine how states are filling gaps in federal law.