By: JoAnn Volk and Justin Giovannelli

Health care sharing ministries (HCSMs) are arrangements in which members who follow a common set of religious or ethical beliefs agree to contribute regular payments to help pay the qualifying medical expenses of other members. HCSMs may look like insurance — and are often offered as an alternative to Affordable Care Act (ACA) plans – but they are not. HCSMs do not promise to reimburse enrollees for qualifying medical expenses and are not required to meet financial standards to ensure they have sufficient funds to pay claims. As such, states usually don’t regulate them as insurers, meaning HCSMs are exempt from all federal and state health insurance consumer protections.

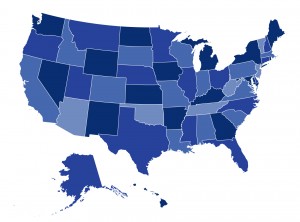

In the last year, state regulators have stepped up their scrutiny of HCSMs to warn consumers of their limits. To date, Colorado, Connecticut, New Hampshire, Texas and Washington have taken legal action against one HCSM, Aliera, for allegedly engaging in fraudulent activity and deceptive marketing that has left consumers with unpaid bills. Meanwhile, the National Association of Insurance Commissioners and at least 15 states have issued consumer alerts warning of the risks posed by HCSMs. But states can do more than issue warnings about HCSMs. At a minimum, regulators in “safe harbor” states that explicitly exempt HCSMs from insurance regulation could require HCSMs to demonstrate compliance with the state’s exemption rules. All states could require greater transparency and address broker-driven sales – actions some states have taken in the last year.

In a new post for The Commonwealth Fund, we look at recent state action to protect consumers from the risks of HCSMs and map out other options for states to step up their scrutiny of these arrangements. You can find the post here.