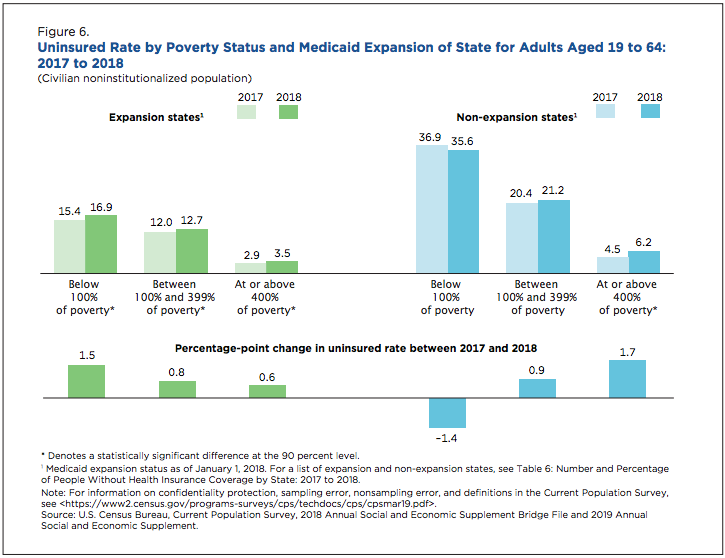

The latest U.S. Census data show the uninsured rate for nonelderly adults is rising, including among middle- and higher-income people who do not qualify for Affordable Care Act premium (ACA) subsidies. Such an increase is partly attributable to policies implemented by the Trump administration to undermine the Affordable Care Act, which in turn resulted in significant premium increases for unsubsidized individuals between 2016 and 2018. When it comes to individual market enrollment, however, national numbers mask significant differences in state-to-state performance.

Berschick, ER, Barnett JC and Upton RD. Health Insurance Coverage in the United Sates: 2018. U.S. Census Bureau, September 2019.

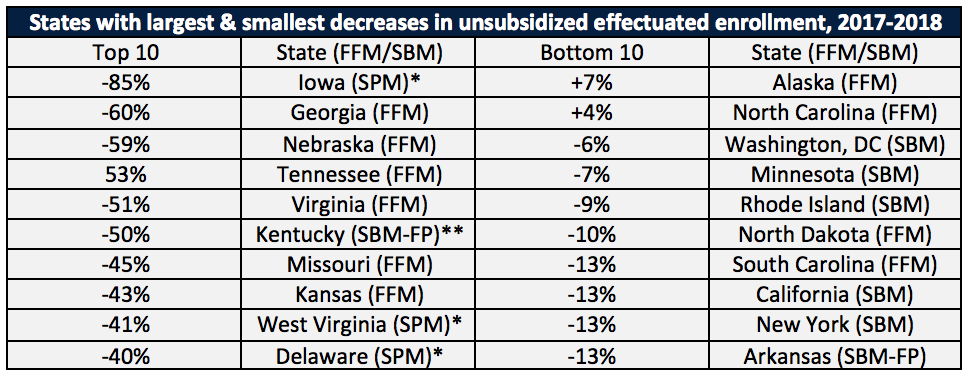

On August 12, 2019, the Centers for Medicare & Medicaid Services (CMS) released their Early 2019 Effectuated Enrollment Snapshot, a report that provides data on effectuated enrollment (defined as those who selected an insurance plan and paid their first month’s premium), for the federally facilitated marketplace (FFM) and state-based marketplaces (SBMs). Because the drop in enrollment between 2017 and 2018 occurred primarily among unsubsidized individuals – a decrease of 24 percent – CMS released an additional report analyzing state-level trends in unsubsidized enrollment.

CMS Report: SBMs outperform FFMs

The results from the report are striking: on average, unsubsidized effectuated enrollment between 2017 and 2018 dropped by an average of 16 percent across SBMs, compared to 30 percent across FFM states. Nine of ten states with the largest declines in unsubsidized enrollment are all FFM states, while six of the ten states with the lowest declines are SBMs (see table).

*In State Partnership Marketplaces (SPM), states cede marketplace functions to the FFM except for plan management and, in some cases, consumer assistance. For the purposes of this analysis, we consider these states to be FFM states. **In SBMs that use the federal platform (SBM-FP), states are responsible for marketplace functions except for the operation of the IT platform for eligibility and enrollment. For the purposes of this analysis, we consider these states to be SBM states.

Notably, the two states with increases in unsubsidized enrollment in 2018 benefited from a successful reinsurance program (Alaska) and large investments from private philanthropy in outreach and enrollment (North Carolina).

SBMs are less vulnerable to federal policy changes and uncertainty

When the ACA was enacted, policymakers envisioned the states operating their own marketplaces. However, most states opted either to cede all marketplace functions to the federal government, or to take on only some functions, such as plan management, while leaving eligibility determinations and plan enrollment to the FFM.

Those states that opted to use the FFM are more directly exposed to federal policy changes. In 2017, the Trump Administration announced the end of cost-sharing reduction (CSR) payments, reduced advertising and outreach funding, and expanded the availability of non-ACA compliant coverage. Additionally, Congress voted to zero out the individual mandate penalty. Taken together, these federal actions, as well as several months of Congressional debate over repealing the ACA, caused instability in the individual market, with the threat of bare counties, skyrocketing premiums, and diminished enrollment. Additionally, the Trump Administration recently floated the idea of banning silver-loading, a tool used by most states to support stabilization following the end of CSR payments. FFM states have little ability and often have less state-level political support for policies that would soften the blow of such policy changes.

Other federal policies also affect FFM states more than SBMs. For example, the federal government charges a user fee to insurers on the FFM, which has been 3.5 percent of plan premiums since 2014. However, beginning in 2017 the federal government cut back dramatically on marketplace advertising, outreach, and consumer assistance. The administration has also deferred more and more plan management decisions to state departments of insurance. As a result, since 2017, residents of FFM states have been getting a much smaller bang for their health plan buck. Further, FFM states do not control Open Enrollment periods (OEP). In 2017, the Trump Administration shortened the OEP from 12 to just 6 weeks. SBMs, because they have their own platforms, have the authority to extend OEPs (and many of them did) while FFM states are at the whim of federal policymaking.

SBMs are more likely to have state-level policies that support the ACA

State-run marketplaces are, more often than not, also states that have policies on the books that support the ACA. SBMs were more likely than FFM states to ban the Obama administration’s so-called “grandmothered” plans, which kept healthy people out of the ACA-compliant market.

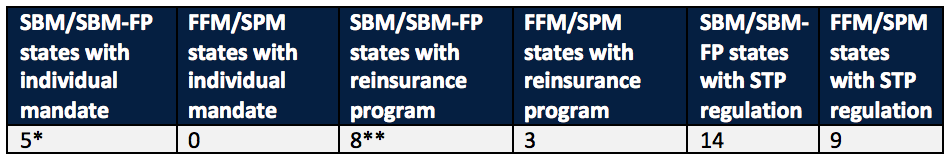

More recently, SBM states have been more likely to implement a state-level individual mandate and a state-based reinsurance program. Additionally, states can regulate their individual markets to steer consumers to ACA-compliant comprehensive health insurance plans through policy tools such as regulating short-term plan (STP) sales.

*New Jersey implemented an individual mandate while still an FFM state. **Pennsylvania intends to launch their reinsurance program in 2021. Maine implemented a reinsurance program while still an FFM state.

SBMs also have the flexibility to extend the open enrollment period, fund Navigator and outreach programs, enhance premium subsidies, and leverage their Medicaid participation for the individual market, among others.

Investing in outreach and enrollment makes a difference

The significant reduction in the outreach, enrollment, and advertising funds at the federal level despite well-documented success led the states into a natural experiment. All state-based marketplaces invested significantly more money into marketing and outreach than the FFM did, and the effectuated enrollment numbers show it: since 2016, enrollment in SBMs has increased 0.9 percent while enrollment in FFM states decreased by 3.7 percent. While the enrollment numbers are not completely attributable to outreach and advertising, an estimated 20 percent of the decline in the uninsured rate of higher income individuals was attributable to outreach and marketing efforts, and another study found that higher TV advertising volumes were associated with higher enrollment in 2014.

What’s next? More states are transitioning to SBMs

At the time of writing, there are currently six states moving or contemplating a move to become a full SBM. States cite numerous reasons in justifying such a move, including cost savings and a greater ability to oversee their markets. To be sure, the proof has been in the effectuated pudding: state-based marketplaces have shown they have the tools to maintain enrollment and support consumers in their individual markets.