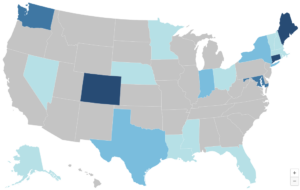

If Expanded Federal Premium Tax Credits Expire, State Affordability Programs Won’t Be Enough to Stem Widespread Coverage Losses

The 2021 expansion of federal premium tax credits (PTCs) drove uninsured rates to a record low in 2023, but this critical financial assistance will expire after 2025 unless Congress acts. CHIR faculty Rachel Swindle and Justin Giovannelli talk more about this in their latest issue brief for the Commonwealth Fund.

What’s New for the 2025 Plan Year Open Enrollment

Substantial Marketplace Coverage Gains for Communities of Color Threatened Again

The Affordable Care Act (ACA) marketplaces have become vital lifelines for millions, especially for communities of color, significantly reducing the uninsured rate and expanding access to affordable coverage. However, the future of these marketplaces hangs in the balance, with political priorities influencing their stability and funding, particularly regarding federal subsidies. As the 2024 election cycle approaches, the choices voters make could reinforce the progress achieved or risk undoing critical health care coverage advancements.

September Research Roundup: What We’re Reading

While the weather may be cooling down, the research is not! This month we read about Medicare Advantage quality bonus payments, out-of-pocket drug costs for consumers, effects of enhanced premium tax credits on older adults, and strategies to increase eligibility verification and receipt of Marketplace subsidies.

CHIR Expert Testifies About Facility Fees Before Texas House Insurance Committee

CHIR expert Christine Monahan recently testified before the Texas House Insurance Committee regarding outpatient facility fee billing. Her research highlights how facility fees contribute to significantly higher healthcare costs. In her testimony, she discussed measures to curtail hospital billing tactics that inflate costs and ways to mitigate financial burdens on patients.

Current Considerations for State Reinsurance Programs

Reinsurance has been a popular mechanism to stabilize insurance markets and reduce premiums. However, some argue that it could negatively affect affordability and enrollment for low-income individuals. In a new article for the State Health & Value Strategies program, Jason Levitis, Sabrina Corlette, and Claire O’Brien review the evidence and discuss considerations for state reinsurance programs.

How Oregon’s Merger Review Law Combats Consolidation and What Other States Can Learn From It

Since the early 1990s, health care provider consolidation in states like Oregon has led to higher prices, reduced access, and worsened health inequities. In response, Oregon established the Health Care Market Oversight Program in 2022 to review major health care transactions, aiming to ensure they reduce costs and improve care access, especially for underserved populations. While the program has approved most transactions so far, concerns about transparency, resource adequacy, and high profit thresholds for review persist. CHIR’s Nadia Stovicek discusses the need for ongoing evaluation and improvement, and how other states can learn from Oregon.