Insurers Eye ICHRAs: Implications For the Small Group and Individual Markets

How States Can Use Tax and Unemployment Filings to Sign People Up for Health Insurance

Easy-enrollment programs offer states an efficient, low-cost mechanism for connecting residents with comprehensive, affordable health care coverage. In a recent post for the Commonwealth Fund, CHIR experts Rachel Swindle, Rachel Schwab, and Justin Giovannelli review state efforts and effective strategies for improving easy enrollment programs and boosting healthcare enrollment.

New Nationwide Data on Outpatient Facility Fee Reforms

As hospitals and health systems expand their ownership and control of ambulatory care practices, they are frequently charging new facility fees for routine medical services delivered in outpatient settings. These bills are driving up premiums and health expenditures for consumers, employers, and, ultimately, tax payers. With support from and working in partnership with West Health, CHIR experts are studying outpatient facility fee billing reforms and share their findings in a new online repository.

New Georgetown CHIR Report on the Federal and State Tools for Responding to Provider Consolidation and Recommendations for Strengthening Them

Over the past 30 years, hospitals and physician practices have been merging at an accelerated pace, and as a result, they have been able to command higher prices for their services. A recent report by CHIR Faculty discusses federal and state mechanisms to address provider consolidation, and what can be done to strengthen them.

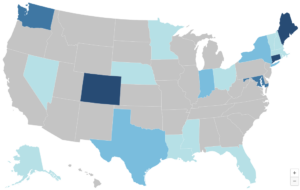

States Increasingly Use Power Over Commercial Health Insurance to Boost Primary Care Investment

The U.S. significantly under-invests in primary care, even though the benefits of primary care access are well known. Several states are now using their health insurance rate review authority to push insurers to increase their investment. CHIR’s Maanasa Kona and Sabrina Corlette review these states’ strategies and their impact to date.

CBO Projections Are Not Destiny: Policies, ACA Investments Can Change Trajectory

The Congressional Budget Office has released its 10-year projections for the country’s health insurance coverage rates. In her latest article for Health Affairs Forefront, CHIR’s Sabrina Corlette reviews the agency’s predictions and provides a roadmap for maintaining – and even improving – our nation’s historically high coverage rates.

Understanding Hospital Financing: Takeaways from the CHIR Webinar Series

May Research Roundup: What We’re Reading

The days are heating up and so is the summer research! This month we read about the effects of health risk assessments on Medicare Advantage payments, how the Affordable Care Act transformed the healthcare landscape in this country, and finally, about hospital pricing and the values of transparency.

New Rule Opens the Affordable Care Act Marketplaces to DACA Recipients

The U.S. Department of Health & Human Services has released a final regulation allowing people who receive Deferred Action for Childhood Arrivals (DACA) to access new health insurance options. CHIR’s Sabrina Corlette and Julian Polaris of Manatt Health review the rule and its implications for state policy.