June Research Roundup: What We’re Reading

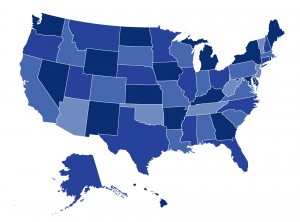

It’s finally summer, and during the latest heat wave, the CHIR team cooled off with new health policy research. In June, we reviewed studies on improving race and ethnicity data collection in health insurance marketplaces, the value of health savings accounts, and variation in medical debt accumulation across the U.S.