In most states, health insurers are required to submit their proposed premium rates for 2022 sometime in July. However, several states ask for – and publicly post – insurers’ proposed rates in May and June. These early rate filings can provide hints about how insurers are responding to market trends, policy changes, and emerging drivers of health care costs. This year, insurers have had to make decisions about benefits, network design, and premium pricing in the wake of a devastating worldwide pandemic and federal policy changes that could dramatically expand coverage under the Affordable Care Act (ACA). To assess how individual market insurers are developing their 2022 premium rates, I reviewed early proposed rate filings in the District of Columbia (D.C.), Maine, Oregon, Vermont, and Washington.

Where’s the Crystal Ball? Rate Review Deadlines Require Long Lead Time

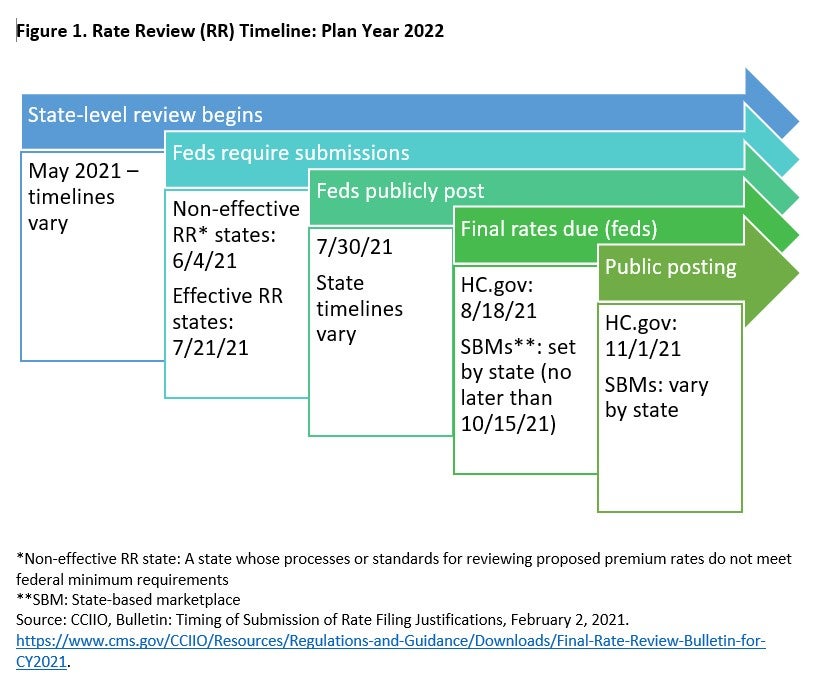

Federal and state law requires insurers in the individual market to set the next year’s premium rates many months before they go into effect. The federal government (through the Center for Consumer Information and Insurance Oversight, or CCIIO) sets deadlines for the submission of proposed and final premium rates, but states have flexibility to require earlier filings. See Figure 1.

Under the current schedule, individual market insurers in all states must have submitted their proposed 2022 premium rates for review by July 21; HealthCare.gov will post their proposed rates by July 31, with final rates publicly posted by November 1. However, material changes in public policy or circumstances can result in federal or state regulators adjusting these deadlines.

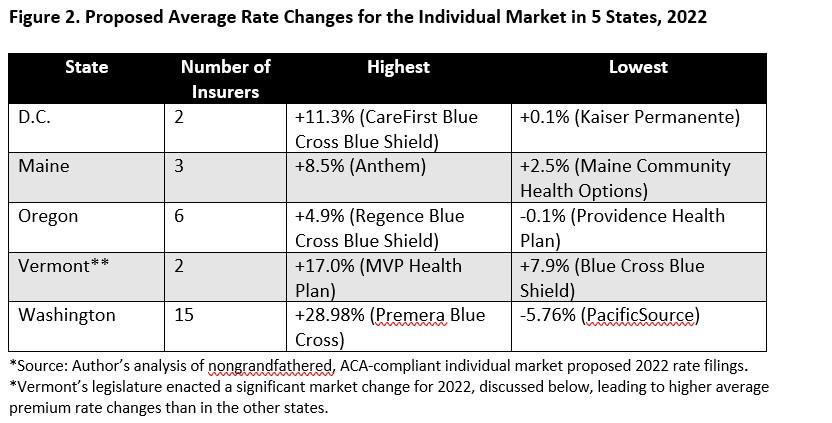

For the most part, insurers in the five states assessed are proposing modest premium increases compared to past years. In some cases, they even propose premium decreases. However, there are some outliers. See Figure 2. In all cases, insurers report that the primary drivers of higher premiums are the ever-rising prices charged by health care providers.

Back to Business as Usual? What Insurers are Saying About the Long-term Effects of COVID-19

There remains a lot of uncertainty over the long-term effects of the COVID-19 pandemic (although a health care cost model from the Society of Actuaries is available to help users assess a range of scenarios). However, most insurers in this scan of early filings appear to consider the COVID-19 pandemic to be a one-time event, with limited, if any, impact on their 2022 claims costs. Kaiser Permanente in D.C. called the pandemic’s effects on its future costs “negligible.” In Oregon, Regence Blue Cross Blue Shield, MODA, and PacificSource’s proposed 2022 rate changes do not include any adjustment for COVID-19. None of the insurers across the study states believe there will be a return to the depressed utilization of elective and preventive care services they observed in 2020. As Washington’s Premera Blue Cross Blue Shield puts it, “To rate appropriately….the base data (2020 experience) needs to be brought up to the utilization level as if Covid-19 did not exist.”

However, several believe that “pent up demand” due to 2020’s delayed services will lead to higher utilization in 2022. Indeed, Providence Health Plan in Oregon included a 7.2 percent “COVID-19 rebound adjustment” in its filing, to account for the services that were deferred in 2020. Others predict that those delayed services will lead to an “exacerbation of chronic conditions,” while several suggested that COVID-19 “long-haulers” could be a source of higher-than-expected claims costs. Premera Blue Cross Blue Shield’s 28.98 percent proposed premium increase, for example, stems in part from a projected 7 percent increase in the overall morbidity of its risk pool, thanks to COVID-19.

A handful of insurers believe that costs associated with COVID-19 booster shots, testing, and treatment will materially affect premiums. United HealthCare is projecting a 1.4 percent increase in health care utilization because of COVID-19-related services. Harvard Pilgrim in Maine projects that the vaccine boosters alone will add 1 percent to 2022 claims costs, while MVP Health Plan of Vermont is attributing 0.3 percent of their 2022 premiums to vaccine costs. Conversely, Maine’s Community Health Options noted that their vaccine costs are projected to be just one-half the cost for testing, leading them to assume a reduction in COVID-19-associated claims costs of 0.5 percent. Others still have concluded that there is sufficient uncertainty about post-COVID-19 utilization that they decided not to include the potential of higher utilizations in their 2022 projections, or plan to draw from reserves to cover those costs.

A few insurers reported that they are keeping a close eye on telehealth claims, which skyrocketed under COVID-19’s social distancing and stay-at-home strictures. Kaiser Permanente’s filing took a common view: “We anticipate the high utilization of telehealth services to persist beyond the lifespan of the outbreak into the foreseeable future.” MVP in Vermont suggests that these costs will add to, rather than replace, costs associated with in-person ambulatory services, noting that while in recent months they’ve observed a return to in-person physician visits approaching pre-pandemic levels, they have not seen a commensurate decline in telehealth services.

Blue Cross Blue Shield of Vermont also projects that high claims costs for mental health services, both in-person and via telemedicine, will outlast the pandemic. The carrier expects its mental health and substance use services claims to increase by about 20 percent between 2020 and 2022.

Insurers Predict Modest, If Any, Enrollment Expansion Under the American Rescue Plan

Over 1.2 million individuals have enrolled in marketplace health plans since the February 2021 start of a COVID-19 “special enrollment” opportunity and the introduction of enhanced premium tax credits under the American Rescue Plan. Going forward, insurers’ early rate filings indicate state-to-state differences in insurers’ projections regarding enrollment growth in 2022. Several insurers in Washington State, such as Molina, United, and the Coordinated Care Corp (a Centene company), predict that their 2022 enrollment will grow due to the American Rescue Plan, and that those new members will be, on average, healthier than the existing risk pool; for Molina the American Rescue Plan is contributing to a 3.5 percent decrease in rates.

Others expect that the American Rescue Plan will lead to higher enrollment in the individual market as a whole, but do not project any additional enrollment for themselves in 2022. However, this market growth will contribute to overall improvements in the risk pool. For example, Regence Blue Cross Blue Shield in Washington “projects a 4 percent increase in market size corresponding to a 2 percent decrease in average morbidity from 2020 to 2022.”

Conversely, in Vermont and D.C., where the rate of uninsured is already very low compared to other states, health insurers do not believe the American Rescue Plan will result in a significant increase in enrollment in the individual market. These carriers predict no change in their own membership, and they do not expect that the overall individual market risk pool will become healthier.

State-specific Issues: Un-merging Markets in Vermont; Year 2 of Washington’s Public Option Plans

State-level policies and market trends will also affect insurers’ premiums. For example, for many years Vermont has been among a handful of states that merged the markets for individual and small employer insurance. This means that insurers must use the claims experience of both individuals and small employer groups to set rates across both markets. This year, legislators decided to un-merge the markets, effective January 1, 2022. This resulted in a one-time increase in individual market rates, but a decrease in small-group market rates.

Washington State is the only state with an established public option plan program, which launched in January of 2021. As we’ve written previously, the first year of the program generated disappointing results, with higher-than-expected premiums, limited geographic reach, and low enrollment. A perusal of insurers’ 2022 rate filings suggests next year will be little different. Insurers who propose to offer public option plans are doing so in far fewer counties than non-public option plans, and at least in some cases, at higher prices.

Looking Ahead

With respect to COVID-19, insurers appear convinced that use of health care services will return to pre-pandemic levels – and in some cases even higher – in 2022. Many are also concerned about long-term impacts of the pandemic, including increased morbidity due to delayed, but necessary, primary and preventive care, as well as costs associated with COVID-19 “long-haulers.” Insurers are also watching their telehealth claims, with many predicting that these costs will add to, not replace, their costs for brick-and-mortar physician services.

Some insurers also appear hesitant to ascribe much enrollment growth, or improved morbidity, to recent policy actions, including the extension of open enrollment periods and increased subsidies under the American Rescue Plan. Also missing from insurers’ analyses is the impact of the end of the federal Public Health Emergency, which could prompt millions of people to transition from their state’s Medicaid program to an individual market health plan. However, in all the study states, regulators will conduct a review of insurers’ assumptions and projections, and may ultimately approve rates lower than those proposed.

*My review of these rate filings was largely limited to the narrative “actuarial memos” that must accompany each rate filing. These memos explain, in lay language, insurers’ past experience, current assumptions, and predictions for the next plan year.

The author thanks Christina Goe, Kevin Lucia, and Kathy Hempstead for their thoughtful review and comments on this post.

1 Comment

It’s interesting to read about the early filings of health plans for 2022. It’s good to see that they are taking steps to adjust to changes in the healthcare landscape and offering more affordable options. I hope this trend continues, and more people can access quality healthcare at a reasonable cost.

14 Trackbacks and Pingbacks