By Justin Giovannelli and Emily Curran

The Affordable Care Act’s (ACA) marketplaces were designed to make it easier for people to view their health insurance options in one place, compare key features of plans, and choose coverage that is best for them. Three years after their launch, the uninsured rate is at an historic low; financial assistance has encouraged millions to sign up for insurance; and most marketplace enrollees say they are satisfied with their coverage. Still, for many consumers, shopping for a suitable health plan remains daunting; individuals who are not eligible for a subsidized premium have shown relatively little interest in using the marketplaces to find a plan; and the costs of coverage persist as a major barrier to care.

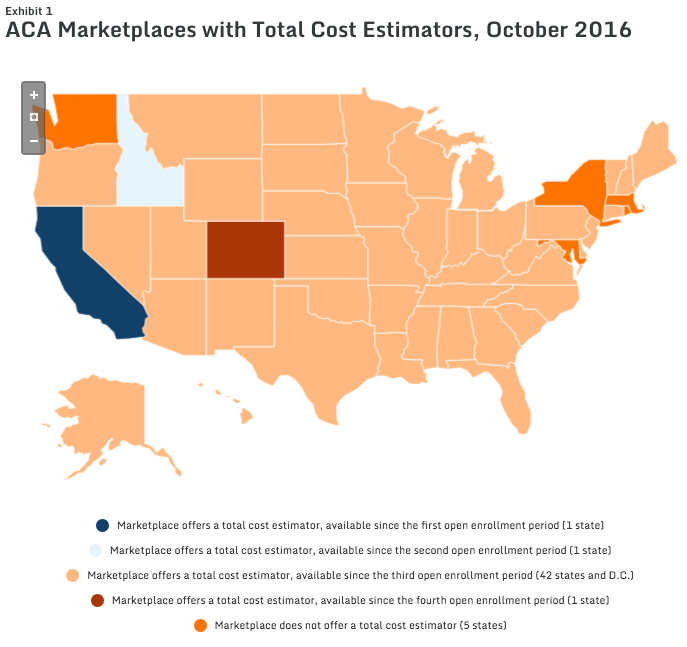

One area marketplaces have sought to improve is the shopping experience. Health insurance is complicated; many people have difficulty understanding and applying key insurance concepts. The complexities are compounded when individuals must weigh the features of competing plans—a task most people dread and do not do well. To support better enrollment decisions, most marketplace websites offer a tool to help consumers estimate the total cost of their coverage options. Total cost estimators are available on HealthCare.gov and in eight state-run marketplaces, reaching consumers in the vast majority of states.

For their recent issue brief for the Commonwealth Fund, CHIR researchers Justin Giovannelli and Emily Curran interviewed more than 40 marketplace officials, consumer assisters, technology vendors, and other subject matter experts to see how having an estimator can change consumers’ experiences in the marketplace and to understand the concerns of policymakers as they have considered whether and how to implement these tools.

To learn more about their findings, visit the Commonwealth Fund brief here.