How States Can Use Tax and Unemployment Filings to Sign People Up for Health Insurance

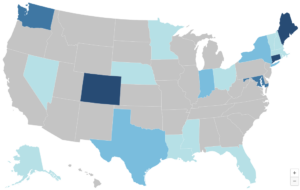

Easy-enrollment programs offer states an efficient, low-cost mechanism for connecting residents with comprehensive, affordable health care coverage. In a recent post for the Commonwealth Fund, CHIR experts Rachel Swindle, Rachel Schwab, and Justin Giovannelli review state efforts and effective strategies for improving easy enrollment programs and boosting healthcare enrollment.