By Sabrina Corlette, Ashley Williams, and Justin Giovannelli

High prices for prescription drugs have been in the news lately. There is the eye-popping price of the life-saving hepatitis C drug Sovaldi ($1,000 a pill) and the announcement that Turing Pharmaceuticals would increase the price of Daraprim, a drug to treat a rare but serious infection, by 5,000 percent.

At the same time, insurance companies are shifting drug costs onto consumers, largely through changes in their drug formulary designs. Although many insurers have long had tiered formularies that offer low cost-sharing for generic drugs and higher cost-sharing for brand-name drugs, the practice has expanded in recent years, with insurers adding an upper tier to their formularies. These so-called specialty tiers have very high cost-sharing, often through coinsurance (a percentage of the total cost) instead of a copayment (a fixed dollar amount).

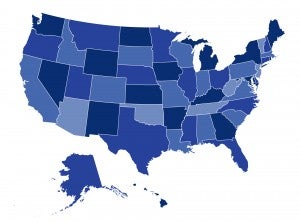

A number of states have enacted policies to help consumers reduce out-of-pocket spending on drugs. In our latest blog post for the Commonwealth Fund, we’ve identified at least seven states that have taken recent action to lower the burden of high-price prescription drugs, both inside and outside the insurance marketplaces. And seven state-based marketplaces require insurers to offer standardized benefit designs that also place limits on pharmaceutical cost-sharing. To learn more about these state policies, click here.