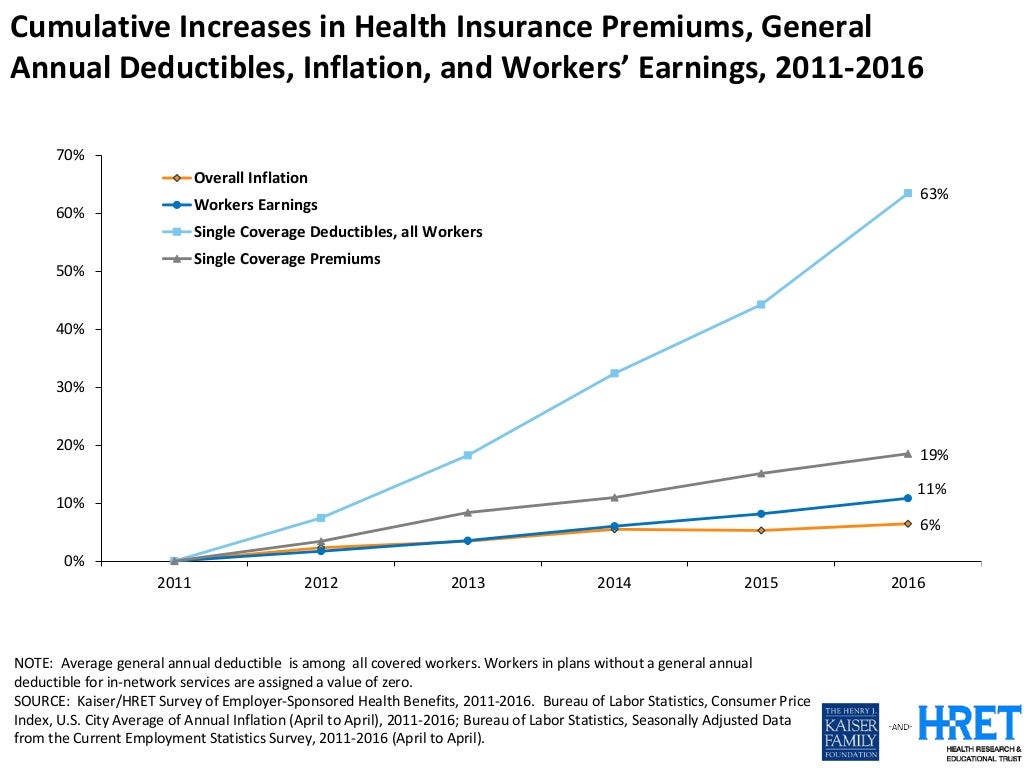

A graph has been making the rounds on the internet comparing cumulative increases in deductibles since 2011 to growth in inflation, worker earnings and health insurance premiums since it was posted as part of a Wall Street Journal blog.

The graph is alarming because it shows deductibles in employer sponsored plans soaring above all other lines. But the graph only tells part of the story – the part that occurred after 2011. The story of increasing deductibles in employer based health insurance is a story that is over a decade in the making.

Source: Kaiser Family Foundation and Health Research and Education Trust, Employer Health Benefits 2016 Survey

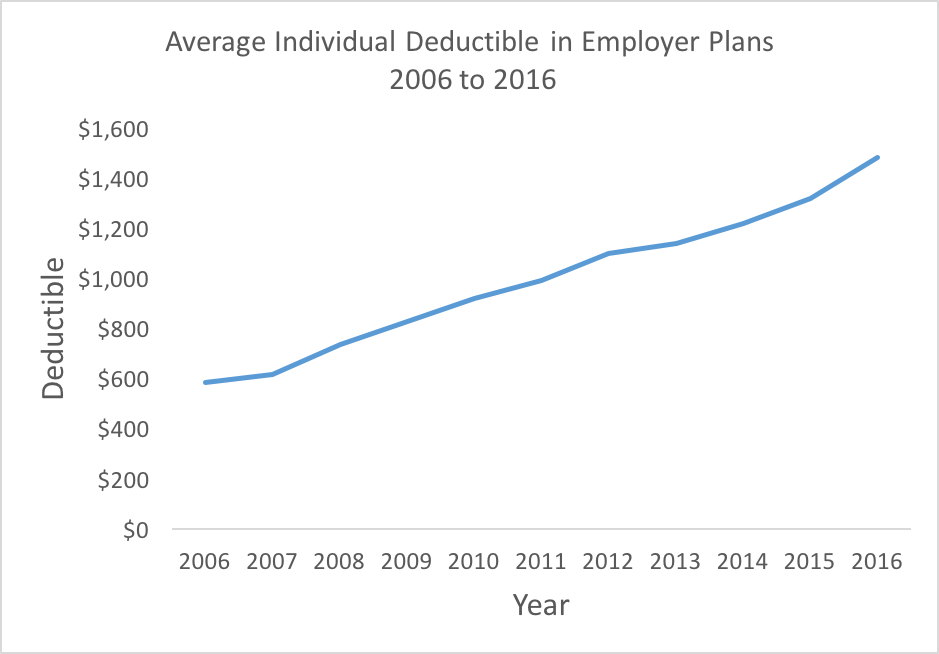

In fact, deductibles have been rising steadily for a decade and more. The Kaiser Family Foundation’s 2006 survey reported that, in 2003, the average individual deductible in an employer based HMO was only $30. By 2006 the average individual deductible in an HMO was 11.7 times higher at $352 – an increase of 1,073% (yes, that is an increase of over one thousand percent in three years).

Over the last 10 years, the average individual deductible in all employer plans has increased an average of 9.8% each year. The increase in 2016 was above average at 12.1% – a big jump but also below the increases the year before and the year the Affordable Care Act (ACA) passed. In 2008 the average single deductible increased by 19.3% and in 2009 the average single deductible increased by 12.4%.

What does this mean?

It doesn’t mean rising deductibles are not a problem. They are. Deductibles reduce health care spending because people use less care – and some of the care people forgo is necessary care. Some people forgo care because they cannot afford it. Others are forced to go into medical debt in order to receive health care services they need.

But let’s be clear – the rise in deductibles in employer-based plans is not caused by or even exacerbated by the ACA. This is a trend that existed years before the ACA and worsened as the ACA was debated. They are a function largely of rising health care costs and employers’ efforts to contain those costs by shifting them onto employees. If anything, the ACA helps reduce the burden of deductibles because many workers and their families now have access to preventive services without cost sharing. But as deductibles continue to rise, it is important to ask what more can be done to keep the cost of health care from shifting to employees and their families?

Ultimately this means tackling the supply side of health care – specifically the ever-rising prices charged by providers, drug manufacturers and others. But the burden of doing so shouldn’t fall solely on consumers’ shoulders. As we wrote here two years ago, we need to strengthen all pillars of coverage. To strengthen employer coverage, we must address the trend of the ever increasing deductible.