Category: CHIR

How States Can Use Tax and Unemployment Filings to Sign People Up for Health Insurance

Easy-enrollment programs offer states an efficient, low-cost mechanism for connecting residents with comprehensive, affordable health care coverage. In a recent post for the Commonwealth Fund, CHIR experts Rachel Swindle, Rachel Schwab, and Justin Giovannelli review state efforts and effective strategies for improving easy enrollment programs and boosting healthcare enrollment.

New Nationwide Data on Outpatient Facility Fee Reforms

As hospitals and health systems expand their ownership and control of ambulatory care practices, they are frequently charging new facility fees for routine medical services delivered in outpatient settings. These bills are driving up premiums and health expenditures for consumers, employers, and, ultimately, tax payers. With support from and working in partnership with West Health, CHIR experts are studying outpatient facility fee billing reforms and share their findings in a new online repository.

New Georgetown CHIR Report on the Federal and State Tools for Responding to Provider Consolidation and Recommendations for Strengthening Them

Over the past 30 years, hospitals and physician practices have been merging at an accelerated pace, and as a result, they have been able to command higher prices for their services. A recent report by CHIR Faculty discusses federal and state mechanisms to address provider consolidation, and what can be done to strengthen them.

Understanding Hospital Financing: Takeaways from the CHIR Webinar Series

May Research Roundup: What We’re Reading

The days are heating up and so is the summer research! This month we read about the effects of health risk assessments on Medicare Advantage payments, how the Affordable Care Act transformed the healthcare landscape in this country, and finally, about hospital pricing and the values of transparency.

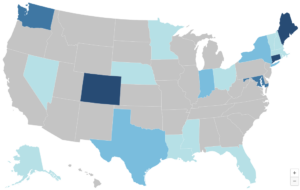

Facility Fee State Legislative Roundup: 2024 Session

With more outpatient care being delivered in hospital outpatient departments (HOPDs) than in previous years, consumers increasingly face high hospital facility fee charges on top of their provider’s bill for routine medical care. CHIR’s Hanan Rakine discusses the 2024 legislative session and how different states have been successful in regulating outpatient facility fees.

Raise the Bar: State-Based Marketplaces Using Quality Tools to Enhance Health Equity

In a new post for the Commonwealth Fund’s To The Point blog, CHIR’s Jalisa Clark and Christine H. Monahan describe how Washington and California’s quality programs are focusing on equity and highlight opportunities for other state-based marketplaces to similarly strengthen their own quality programs.

Improving Health Care Competition: Federal and State Perspectives

On Tuesday, May 21st, Georgetown University’s Center on Health Insurance Reforms held the final of three events in its series on the Futures of Employer-Sponsored Health Insurance. Event speakers Stacy Sanders, Erin Fuse Brown, David Seltz and Charles Miller discussed competition in health care from the federal and state perspectives.