Policy Innovations in the Affordable Care Act Marketplaces

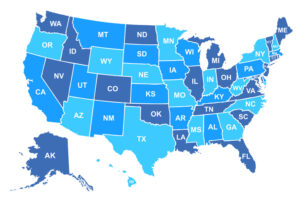

The Affordable Care Act’s Marketplaces have seen record signups for 2024. Marketplaces can pursue innovative and consumer-friendly policies that bolster this crucial source of coverage. In a recent issue brief for the Commonwealth Fund, CHIR experts reviewed policy decisions across state-run Marketplaces and the federally facilitated Marketplace.