In most states, health insurers are required to submit their proposed premium rates for 2021 sometime in July. However, several states ask for – and publicly post – insurers’ proposed rates in May and June. These early rate filings can provide hints about how insurers are responding to market trends, policy changes, and emerging drivers of health care costs. This year, insurers are making projections about health care prices and utilization in the middle of a pandemic and its economic fallout, before anyone has sufficient data to understand fully what the impact of COVID-19 might be (although a recently released 2021 health care cost model from the Society of Actuaries is now available to help users assess a range of scenarios). Insurers in the Affordable Care Act (ACA) marketplaces must also contend with the long-term effects of policy changes such as the 2019 repeal of the individual mandate penalty and the continued promotion of short-term health plans and other alternative insurance products.

To assess how insurers are developing their 2021 premium rates, I reviewed their preliminary actuarial filings in the District of Columbia (DC), New York, Oregon, Vermont, and Washington.*

Tick Tock: the 2021 Rate Review Calendar

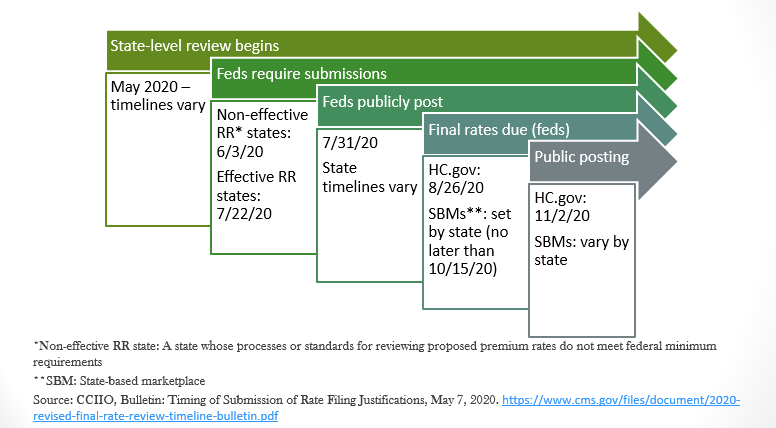

Federal and state law requires insurers in the individual market to set their rates each year months before they go into effect. The federal government (through the Center for Consumer Information and Insurance Oversight, or CCIIO) sets deadlines for the submission of proposed and final premium rates, but states have flexibility to require earlier filings. See Figure 1.

Figure 1. Rate Review (RR) Timeline: Plan Year 2021

Under the current schedule, individual market insurers in all states must have submitted their proposed 2021 premium rates for review by July 22; for insurers on HealthCare.gov (HC.gov), their proposed rates will be publicly posted by July 31. HC.gov insurers must submit their final rates by August 26, with these rates publicly posted by November 2. However, material changes in public policy or circumstances can result in federal or state regulators adjusting these deadlines. For example, in October 2017, when the Trump administration announced it would end subsidies for the cost-sharing reduced plans insurers are required to offer on the marketplaces, regulators in most states permitted insurers to make last minute changes to premiums to make up for the expected losses. Given the uncertainties associated with the coronavirus pandemic, state and federal regulators could give insurers similar flexibility this year.

What are Insurers Saying about COVID-19 Costs?

In these early filings, most insurers are not – yet – proposing dramatic premium increases to account for COVID-19 costs. COVID-19 cost estimates for most vary from a net zero impact to 5 percent of premium, with most projecting a 0-2 percent impact. Fidelis (a subsidiary of Centene) in New York is an outlier, projecting an 8.4 percent COVID-19-related cost increase. However, almost all carriers point to what one called “unprecedented uncertainty” over the course of the pandemic and the resulting economic downturn that could require them to revisit their initial projections. Many insurers made statements to regulators similar to this one, from CareFirst Blue Cross Blue Shield in DC: “[W]e are still in the early stages of this event, and it is unclear how the emerging experience will impact rates either positively or negatively. We intend to update assumptions as appropriate as experience emerges during the review process.”

Many carriers suggested that their actuaries were modeling a range of scenarios with respect to the pandemic and related economic trends, with widely varying outcomes. For example, PacificSource Health Plan in Oregon reports that their models show COVID-19 costs ranging from $0.14 per member/per month (PMPM) to as much as $35.53 PMPM.

There are multiple factors in play, some of which would drive rates up, others down.

Costs of COVID-19 treatment

In general, insurers do not project that COVID-19-related treatment costs will be a large factor driving up premiums. For example, Molina in Washington reports: “From our nascent experience we have observed relatively low hospitalization rates for COVID-related services.” MODA of Oregon projects that roughly 650 of its 34,263 policyholders will be hospitalized with COVID-19 in 2021, costing, on average, $50,000 per hospitalization. However, other carriers note that the long-term effects of COVID-19 on patients are still unknown.

Availability and cost of a vaccine

Of those insurers discussing potential vaccine costs, all assume they will be covering and waiving cost-sharing for vaccinations, but they differ in their projections of take up and price. For example, MVP in Vermont projects the vaccine will cost $75 per dose and 80 percent of their enrollees will get vaccinated. On the other hand, Providence Health Plan of Oregon predicts only a 30 percent utilization rate, but a cost per dose of $200. Molina projects a 90 percent utilization rate at a cost of $200 per dose, although they expect the resulting 21.3 percent increase in pharmaceutical claims will be offset by avoided high-cost hospital admissions.

Diagnostic and antibody testing costs

To date, federal and state requirements that insurers cover and waive cost-sharing for COVID-19 tests do not appear to be contributing to rising costs. Indeed, Providence Health Plan of Oregon reports that, to date: “[T]he impact of additional expenses due to testing and treatment have been more than offset by a reduction in non-emergency services as a result of care delivery systems freeing up personal protective equipment and hospital capacity.” However, several carriers warn, as did the Capital District Physician’s Health Plan of New York, that widespread, frequent charges for testing could “wipe out” current savings due to lower utilization of non-COVID-19 services. Independence Health of New York suggests that a requirement to cover all COVID-19 testing could increase premiums between 5 and 15 percent, depending on the number of tests provided to each enrollee.

Return of delayed elective procedures

Most insurers predict that elective procedures delayed in 2020 due to social distancing strictures will resume before 2021. Some are also predicting that, to make up for lost revenue, providers will deliver more procedures than usual. For example, MVP Health Plan in Vermont predicts that, beginning in August 2020, providers will perform 110 percent of prior elective service volume until all the deferred services are “fully performed.” The MVP Health Plan of New York estimates this uptick will add 0.5 percent to the premium, while Oscar (New York) predicts a 1.7 percent impact. Conversely, Blue Cross Blue Shield of Vermont (BCBSVT) notes that 2021 could bring continued deferrals of elective services, if a resurgence of the virus calls for additional social distancing measures.

A “Second Wave”

Several carriers predict there will be another spike in the number of people infected with COVID-19, likely carrying over into 2021. MODA Health Plan of Oregon projects a 0.9 percent increase in costs as a result, asserting: “Because of the planning that has been done to provide adequate PPE [personal protective equipment] to the provider community, we do not expect the next wave to result in any suppression of non-COVID-19-related claims.”

Impact on population health

Several carriers predict a worsening of overall population health, due not only to the spread of COVID-19, but also the effect of delayed (but necessary) primary and preventive care and an increase in mental health troubles caused by COVID-19-related stress and economic hardship. “It is clear that population health will worsen as a result of the pandemic,” writes BCBSVT, “but the magnitude of the deterioration is difficult to predict.”

Market shifts

Several carriers predict they will lose enrollment in employer-sponsored health plans (particularly among small businesses), but some noted that those losses could be offset, at least partially, by gains in their individual market products. Further, some carriers, such as BCBSVT, noted that these new individual market enrollees would likely be healthier than their existing enrollees.

Contributions to Surplus/Capital Reserves

While several insurers did not include COVID-19-related costs in their filings, some of these are seeking to make significant contributions to their surplus in order to account for the “unknown effects of Covid-19 on customer and provider behaviors.” For example, Premera in Washington estimates it will need to devote 6-8 percent of premium to its surplus.

Effect of State Mandates, including Coverage of Testing, Telehealth, Mental Health, and other Services

Many states directed insurers to expand coverage of COVID-19 and other health care services, lower bureaucratic barriers to services, such as prior authorization requirements, and provide premium grace periods to policyholders. New York insurer Excellus tallied up the cost of the state’s COVID-19-related mandates, concluding that, combined, they accounted for 0.27 percent of the total premium.

Other Considerations: The Health of the Individual Market

Insurers were mixed about the impact of the repeal of the federal individual mandate penalty. Not surprisingly, carriers in D.C., which enacted its own individual mandate penalty, are unconcerned about any deterioration in the health status of the individual market. Indeed, CareFirst is actually predicting the overall health status of the market could improve in 2021.

The expectations of insurers in states without an individual mandate penalty were mixed. Several carriers, such as Providence Health Plan, MODA, and Premera do not expect any changes in the health status of the individual market risk pool. Molina, operating in Washington state, expects the health status of its enrollees to improve. Conversely, Centene, which markets plans in Washington through Coordinated Care Corporation, and Excellus, in New York, both predict the individual market will get sicker, due to the repeal of the individual mandate. For Excellus, this will add 1.5 percent to its 2021 premium.

State-Level Policies: Oregon’s Reinsurance Program and Washington’s Public Option

After the ACA’s reinsurance program ended in 2016, Oregon adopted its own individual market reinsurance program. The program will run through 2022, and continues to exert downward pressure on premiums. In their 2021 rate filings, Oregon insurers project that the program will lower their claims expenses between 10 and 13 percent.

In its 2019 legislative session, Washington authorized new public option plans to expand affordable coverage options to people in the individual market. The law also required individual market insurers to offer plans with standardized benefit design that reduce consumers’ cost-sharing for certain high-value services, such as primary care visits. Insurers offering public option plans are also required to limit the amount they pay providers. Based on initial rate submissions, of 15 carriers planning to participate in the individual market in Washington, only five intend to offer public option plans. However, two of these five insurers – United HealthCare and Community Health Network of Washington, both new market entrants – are exclusively offering public option plans.

Notably, among the three insurers offering both public option plans and traditional marketplace plans, the public option tends to be more expensive. This could be because these plans appear to have more generous benefits (as measured by each plan’s “actuarial value”) than the traditional offerings.

Looking Ahead

Although projections vary considerably among insurers, most are not asking for large rate increases due to COVID-19. However, almost all seek permission to adjust their rates before they are final, as new data about the course of the pandemic and its costs emerge. Although regulators are likely to give insurers some additional leeway in submission deadlines and the ability to make rate adjustments, an extra few weeks or months will likely be insufficient for anyone to have a clear picture of the course of the pandemic or its longer-term consequences before rates are finalized this fall. As a result, insurers are likely to be conservative in their estimates of future costs, potentially driving rates up higher than in these preliminary filings. It will be important for regulators to demand transparency and a clear break-down of how much of insurers’ 2021 premiums will be due to COVID-19-related costs.

*My review of these rate filings was largely limited to the narrative “actuarial memos” that must accompany each rate filing. These memos explain, largely in lay language, insurers’ past experience, current assumptions, and predictions for the next plan year.

I’d like to thank Dave Dillon, FSA, MAAA, of Lewis & Ellis, and Emily Curran for their review and thoughtful comments on this post.

1 Comment

While it is true that insurance companies have not yet experienced significant financial losses due to COVID-19, it is important to note that this could change as the pandemic continues to evolve.

With the emergence of new variants and the ongoing vaccination efforts, the cost of COVID-19 treatment and prevention may increase or decrease, and the impact on insurance companies will depend on the severity of these changes. Furthermore, there is a potential for long-term health effects for COVID-19 survivors, which may result in increased healthcare costs in the future.

Overall, it is important for insurance companies to closely monitor the developments related to COVID-19 and adapt their strategies accordingly to mitigate any potential financial risks.

1 Trackback or Pingback